PPS Portfolio Choice

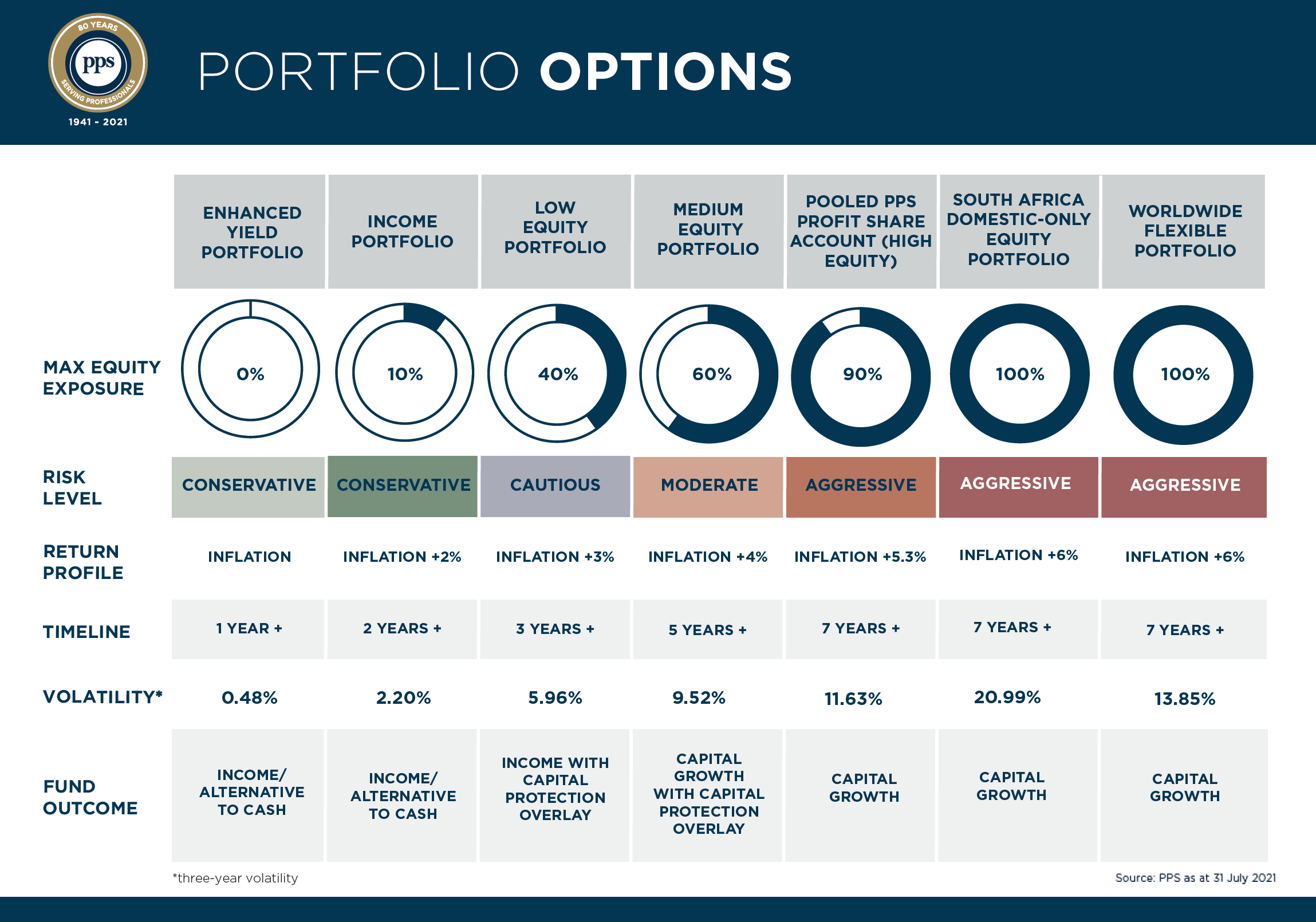

Before reaching retirement – from the age of 55 – PPS offers you the opportunity to start aligning how your PPS Profit-Share Account is invested to align to your retirement plan via the Portfolio Choice.

For more information on the PPS Profit-Share Account Portfolio Choice:

Read - Member Brochure (PDF)

Watch the video - https://youtu.be/KIajotajIuc

For more information on the Portfolio Choices:

Watch the video - https://youtu.be/EeOekUusyFA

Critical Illness/or Severe Illness

Your claim should be accompanied by a PPS claim form from your treating specialist and a PPS Claim form from you. There are separate claim forms for the Professional Health Preserver and PPS Critical Illness Cover. The claim forms should be accompanied by a comprehensive report and copies of any tests done to confirm the diagnosis.

Critical Illness/or Severe Illness

Claims will only be paid under the CATCHALL COVER if the life insured suffers a serious medical or physical condition that is permanent and unlikely to change in spite of further medical or surgical treatment and is not listed in any other benefit categories. To quality for this benefit, you have to score between five and 10 points on the PPS Functional ability table. The award, which pays in tiers of 50%, 75% and 100%, will depend on the Functional ability score obtained.

Critical Illness/or Severe Illness

A survival period will be applied to the dread disease and impairment condition you are claiming for. You have to be alive at the end of the survival period in order to receive a benefit payment. If you die during the survival period no benefit payment will be made, since you would not have incurred the lifestyle adjustment costs resulting from the dread disease or impairment condition which the product is designed to cover.

Important

- A 14- day general survival period always applies;

- Certain conditions have longer survival periods, to determine the permanence or severity of the condition, built into the definitions;

- Heart attack has a 30-day survival period;

- Stroke has a three-month survival period.

Critical Illness/or Severe Illness

This will be based on the assessment of the medical information submitted by your doctor against the definitions/degree of each level as defined in your Policy document.

Critical Illness/or Severe Illness

It is the degree of severity of illness your illness based on the definitions in the PPS Provider Policy or you can refer to your Policy Certificate and Policy document for these criteria.

Critical Illness/or Severe Illness

The award will depend entirely on the information submitted with your claim and the stage of the disease that you are suffering from. If you are awarded a 25% benefit and your condition worsens you may submit a new claim and additional reports which PPS will consider. A further benefit will be paid if your condition meets the definition for a higher severity level.

Critical Illness/or Severe Illness

- Severity level A – 100% of the Sum Assured;

- Severity level B – 75% of the Sum Assured;

- Severity level C – 50% of the Sum Assured;

- Severity level D – 25% of the Sum Assured.

Members who have selected either Comprehensive Cover 100% or Core 100% benefits will be increased as stipulated below:

For members who have selected Core 100%, the award will be 100% for the following conditions as long as the claim meets the requirements of at least a severity level D:

- Heart Attack (Cardiovascular);

- Cardiac Surgery and Procedures (Cardiovascular);

- Stroke (Neurological);

- Cancer.

For members who have selected Comprehensive Cover 100%, the benefit for any of the conditions covered by the Critical Illness Cover will be boosted to 100%, provided it meets the requirements of at least a severity level D.

Critical Illness/or Severe Illness

Depending on the severity of the condition as defined in the policy document, if you are awarded 100% it will be the full sum assured. If you are awarded less than 100% it will be a percentage of the sum assured, as below.

Critical Illness/or Severe Illness

Yes, you can only be paid 100% (100% in total for the accelerated PHP) of the insured amount for each condition covered under your policy. The stand-alone cover remains in force for unrelated conditions for which you can continue to claim should an unrelated event occur. The event paid for will be excluded from future claims if paid at 100% of the benefit.

Critical Illness/or Severe Illness

The entire process should not take more than eight working days to finalise once all the required information has been received;

The process will take longer if additional information is required or if the standard forms have not been completed correctly.

Critical Illness/or Severe Illness

The assessor may request additional information to determine the severity of your illness or when your illness started.

Critical Illness/or Severe Illness

Yes, additional information may be requested from you or your treating doctor. This information will only be requested if sufficient information is not available to assess your claim.

Critical Illness/or Severe Illness

The costs of the initial report, mentioned above will be for your account. In the even that we require additional independent specialist reports then PPS will pay for these reports.

Critical Illness/or Severe Illness

When you are diagnosed with any of the conditions listed in your policy document.

Life Cover FAQ

The remaining half of the life cover sum assured will be paid on death as described above.

Life Cover FAQ

The premiums that you are paying will be reduced accordingly in line with the remaining sum assured.

Life Cover FAQ

The benefit payable will be half the life cover sum assured at the time of claim.

Life Cover FAQ

This benefit is payable if you are diagnosed with a terminal illness (as specified by PPS Insurance) and are likely to die within the next 12 months.

Life Cover FAQ

A Terminal Illness Benefit is automatically included with your life cover.

Life Cover FAQ

The exact same process as above will apply. No immediate needs can, however, be paid from the Profit-Share Account. The Profit-Share Account can also not be ceded.

Life Cover FAQ

The full life cover insured amount as at date of death will be paid based on the beneficiary nomination form unless the policy was ceded (security for a loan). In these instances the cessionary will be paid and the remainder, if any, will be paid to the beneficiaries based on the nomination form.

Life Cover FAQ

The claim should be paid within four working days from the receipt of all the requested information.

Life Cover FAQ

The assessor may request additional information to determine when the illness leading to the death started (dependant on the condition claimed for).

Life Cover FAQ

A request for "Immediate needs" (R50 000) may be submitted to PPS at [email protected] with a copy of the death certificate and banking details and proof (bank letter) of the beneficiaries.

Life Cover FAQ

Notification of death should be sent to [email protected] with a copy of the death certificate and exact cause of death. The relevant documentation will be forwarded to the person submitting the claim.

Life Cover FAQ

From the Master of the High Court.

Life Cover FAQ

| Natural Death | Unnatural Death |

|---|---|

| Death Certificate | Death Certificate |

| Detailed death certificate (BI 1663), if death certificate does not indicate the exact cause of death | Detailed death certificate (BI 1663), if death certificate does not indicate the exact cause of death |

| Banking details of Estate or nominated beneficiary/s | Banking details of Estate or nominated beneficiary/s |

| If paying to Estate PPS requires a letter of executorship | If paying to Estate PPS requires a letter of executorship |

| Copy of ID documents of beneficiaries | Copy of ID documents of beneficiaries |

| If the deceased was divorced copy of divorce order and settlement agreement | If the deceased was divorced copy of divorce order and settlement agreement |

| Medical report from treating doctor |

Police Report (post mortem)

Medical report from treating doctor

|

| If a Trust is nominated PPS requires Copy of Trust deed and Letter of authority of trustees | If a Trust is nominated PPS requires Copy of Trust deed and Letter of authority of trustees |

Life Cover FAQ

The benefit will be paid to the minor child's legal guardian.

Life Cover FAQ

The benefit will be paid to the deceased's Estate.

Life Cover FAQ

If the life insured dies during the benefit term, PPS Insurance will pay the Sum Assured due in respect of the benefit to the nominated beneficiary(ies).

The PPS Professional Disability Provider™ Product (PDP)

The benefit amount is reflected on your PPS Policy Certificate. You can also ask your Financial Advisor for this information.

The PPS Professional Disability Provider™ Product (PDP)

Yes, once the full sum assured has been paid the benefit ends.

The PPS Professional Disability Provider™ Product (PDP)

1. This will depend on whether or not we have enough information with which to assess your claim.

2. Once we have all the necessary information your claim will be prepared for discussion by the Medical Officers Committee. Your claim will be assessed by the Committee within 15 days of receipt of the last piece of information and you will be informed via e-mail of the date on which your assessment will take place.

3. You will receive a letter detailing the decision on your claim within 5 working days of the meeting.

The PPS Professional Disability Provider™ Product (PDP)

This will assist us in ensuring that we make a fair and informed decision regarding your claim.

The PPS Professional Disability Provider™ Product (PDP)

Independent Specialist reports will be paid for by PPS.

The PPS Professional Disability Provider™ Product (PDP)

You may be required to submit a report from an Independent specialist (e.g. Occupational Therapist, Neurologist, etc.). Once the initial documentation has been reviewed, PPS will inform you of any additional requirements.

The PPS Professional Disability Provider™ Product (PDP)

Professional Disability Provider claim form (member);

Professional Disability Provider claim form (doctor);

Comprehensive medical report from your treating specialist/doctor.(if possible please include copies of all relevant test results inclusive of blood test results and x-rays)

The PPS Professional Disability Provider™ Product (PDP)

A claim for this benefit can be submitted when you suffer from a permanent condition (illness/injury) that may prevent you from using your professional training and knowledge to carry out your own occupation or any other occupation that could be carried out by someone with similar qualifications.

Sickness and Permanent Incapacity FAQ

Yes, your claim may include public holidays and weekends.

Sickness and Permanent Incapacity FAQ

PPS will require:

Monthly claim forms will be required, a Declaration by Member from you and a Declaration by Doctor from your doctor.

You will be required to consult your doctor monthly.

If claims are not submitted regularly on a monthly basis there will be delays in the future payment of benefits. The claims management team are required to request information regularly for long term claimants, and if they are not able to do this there will be delays in the assessment of your claim.

Completion of forms based on Telephonic consultations are not accepted by PPS.

Fully completed and signed claim forms (Declaration by Member and Declaration by Doctor Forms) should be submitted to PPS on the 25th of the month you are claiming for.

The Doctor’s Declaration form must be completed by your treating appropriate or relevant Specialist, that is, a doctor who has specialised in the field of medicine related to your condition.

Additional requirements will be communicated to you and may include:

Progress reports/questionnaires from your attending specialist (at PPS’s cost).

Questionnaires to be completed by you (to determine the effect the condition has on your daily activities of living and your ability to perform your usual professional duties).

You may be required to go for an independent assessment at PPS’s cost.

Sickness and Permanent Incapacity FAQ

GPI is personal income and actual expenses derived before tax. As per the terms of the Provider Policy, a member cannot receive sick pay benefits in excess of two-thirds of his/her GPI or total cost to company salary at time of claim. Thus, PPS can perform a financial review when a sick-pay benefit claim has been submitted to determine whether a member has the appropriate amount of cover.

Sickness and Permanent Incapacity FAQ

Usual Professional Duties are those occupational tasks which you carry out as part of your occupation prior to claim. This includes administrative duties such as sending e-mails and making telephone calls related to your business or occupation.

Sickness and Permanent Incapacity FAQ

You may qualify for a Partial Sick Pay Benefit if you are not able to carry out all your normal duties or normal work hours, due to the sickness, but you are able to attend to some of your usual professional duties. ‘Some of your usual professional duties’ means that you have spent time during the working day attending to some of your duties and applying your knowledge and skill related to your nominated occupation. Should you be able to attend to duties related to a different occupation, you must advise PPS of such change of occupation.

You may submit a claim for being able to work on a partial basis which will be considered and paid at a partial benefit rate. Calculations will depend on the benefits held.

Sickness and Permanent Incapacity FAQ

If you have elected to have the Family Responsibility Benefit, and the benefit was effective before 01 April 2017, you will be paid a benefit if your spouse or child is hospitalised for four consecutive days (three nights) or more.

If you have elected to have the Family Responsibility Benefit, and the benefit was effective after 01 April 2017, you will be paid a benefit if your spouse or child is hospitalised for three consecutive days (two nights) or more.

Sickness and Permanent Incapacity FAQ

District, regional and provincial hospitals

Private hospitals

Spinal rehab units

Infectious Diseases hospitals

Rehab Step down facilities (e.g. Life Rehab)

Step Down Institutions

Frail care facilities.

Which hospitals are not covered?

Alcohol and substance abuse rehabilitation centres.

Sickness and Permanent Incapacity FAQ

If you elected to have the Admission Rider Benefit, you will be paid an additional benefit that will be calculated based on the number of days in hospital, multiplied by the cover amount for Admission benefits.

Sickness and Permanent Incapacity FAQ

Your benefit will depend on the sickness cover amount reflected on your Statement of Benefits and will be calculated based on the number of days of sickness.

Sickness and Permanent Incapacity FAQ

No, there is no limit to the number of claims you can submit. However, claims for a condition that is regarded as the same or similar or as a result of an existing condition or related to an existing condition, will be limited to 728 days.

Sickness and Permanent Incapacity FAQ

The entire process should not take more than 8 working days to finalise.

The process will take longer if additional information is required or if the standard forms have not been completed correctly. If the forms have been incompletely filled in by either yourself or your doctor, this will lead to delays

Sickness and Permanent Incapacity FAQ

Fully completed claim forms may be sent to [email protected].

Sickness and Permanent Incapacity FAQ

The assessor may request additional information to determine when your illness started and to get a history of your illness. We may also require a general medical history questionnaire. There may be other reasons why the assessor may call for additional information, for example, to determine the effect the condition has on your ability to attend to your activities of daily living and how the sickness affects your ability to do your work. This could include an Independent Medical Evaluation by a Specialist chosen by PPS or an Occupational Therapy Evaluation.

Special protocol for certain medical conditions:

Mental and Behavioural disorders, fibromyalgia, chronic fatigue syndrome, on-going chronic auto-immune and connective tissue disorders, back conditions,conditions that may have started prior to the business being granted, that could become chronic conditions or are already classified as chronic conditions.

Assessor may ask for:

- Copies of clinical notes from your treating doctor, or usual doctor or the doctor who completed the medical reports at application for the policy.

- Mental and behavioural questionnaire from the doctor who booked you off – Psychiatric claims.

- Medical History Questionnaire from the doctor who booked you off (fibromyalgia/Chronic Fatigue Syndrome/ME/Post Viral Fatigue) - Any chronic fatigue/myalgicencephalitis/connective tissue/auto immune claims.

- General claims Questionnaire completed by yourself.

- The assessor may verify your medical aid records or any other information pertinent to the medical history of your condition. In order to finalise the claim the assessor may request further information directly from members or their treating doctors.

- You may be asked to consult a medical specialist who is an expert in that particular field of medicine relating to your claim.

Sickness and Permanent Incapacity FAQ

Should this period have been extended by the treating specialist/ doctor, the doctor will be asked to provide additional supporting information based on his/her medical examination. Based on this additional supporting information, PPS will be able to make an informed decision on the remainder of the claim period considering the illness and effect thereof on your ability to perform your nominated profession.

Sickness and Permanent Incapacity FAQ

To enable PPS to manage claims and to ensure that all valid claims are paid, the standard recovery times provide a guideline to assessors of what is considered a reasonable period to recover from a specific illness or procedure. The concept of 'standard recovery time' considers current clinical practice and relevant medical literature in conjunction with PPS's claims experience. PPS will approve the sick-pay period which is in line with this current clinical practice.

Sickness and Permanent Incapacity FAQ

A claim form completed by you (Declaration by Member Form)

A claim form completed by your treating doctor (Declaration by Doctor Form)

For Admission benefits we require proof of hospitalisation showing admission and discharge dates (front page of account or discharge form).

For claims relating to your spouse or child, we require a marriage certificate, unabridged birth certificate of the child and proof of medical aid.

For adopted children we require a copy of the official adoption court order and/or official proof of the registration of the adoption with the Registrar of Adoptions, a copy of the marriage certificate pertaining to the Spouse and proof of medical aid for the child.

For the Child Terminal Illness and Death benefit, we require the respective benefit claim forms completed by the member and treating Medical Doctor, the unabridged birth certificate or proof of adoption papers, marriage certificate and a death certificate where applicable.

Sickness and Permanent Incapacity FAQ

No, to claim the Admission Rider benefit you only have to be in hospital for four consecutive days (three consecutive nights) or more.

Sickness and Permanent Incapacity FAQ

When you are sick and unable to perform any of your usual occupational duties due to that sickness:

The SPPI product has two waiting periods, namely, seven (7) days or thirty (30) days. Thus, depending on the waiting period you have chosen, the benefit will pay as follows:

- Seven-day waiting period: A Total Sick Pay Benefit will be considered if you were totally unable to perform any of your usual professional duties for at least seven consecutive days, due to sickness and will pay from day one. Once this initial requirement for a minimum period of seven consecutive days of total incapacity is met, on-going claims can be submitted for continuing total or partial claims.

- 30-day waiting period: A Sick Pay Benefit will be considered if you are unable, either totally or partially, to carry out your usual professional duties for at least 30 consecutive days due to sickness. The Sick Pay Benefit will be paid on either a Total or a Partial basis, whichever is applicable, prospectively from day 31.

Please refer to your policy certificate to confirm if you have a seven-day or 30-day waiting period.

How To Claim

CLAIMS

Tell: 0860 777 784

Monday - Friday

24/7

HOME AND ROADSIDE ASSIST (EMERGENCY SERVICES)

Tell: 0860 777 784

24/7

CLAIMS:

1. All claims must be reported within 30 days of the incident

2. In the case of motor vehicle accidents, notify SAPS within 24 hours of the event

3. In the event of any crime related incident (e.g. theft), report this to the SAPS as soon as possible

4. The Claims Consultants will assist you regarding any further requirements

How To Claim

Follow the easy steps below to get your claim processed fast and efficiently:

1. FILL IN THE CLAIM FORMS

Claims for benefits in terms of the PPS Provider Policy should be submitted as soon as possible after the occurrence of the event that gave rise to the claim in order to ensure efficient claims processing. Claims will only be assessed for the period which you are claiming as reflected in the Declaration by Member form. Claims for future dates will only be assessed up to the date the Declaration by Member form is signed. For on-going claims, claim forms should be submitted on a monthly basis, signed and submitted on the 25th of each month. Click on the relevant benefit tab on the left menu for the claim forms.

2. SUBMIT DOCUMENTS

You will need to submit all the requested claim forms and supporting documents to [email protected]. To assist you, please refer to the FAQ's or the relevant benefit tab on the left menu.

3.WE'LL CONTACT YOU TO NOTIFY YOU OF THE OUTCOME OF YOUR CLAIM

FOR CLAIMS CALL: 010 085 3820

Claims

You can send an email to [email protected];

Alternately contact PPS on 010 085 3820.

Claims

Yes you may. Your application will be subject to the standard PPS underwriting policy and PPS will consider the information relating to the claim submitted. In some instances such an application may be deferred for a period of time depending on the medical condition you are claiming for. This will be communicated to you by the PPS Underwriting Department.

Claims

The benefit will be paid to your premium paying account, unless you request PPS to pay to a different account. If you want the payment to be made into a different account, you will be required to provide PPS with proof of the account which can be a letter from the bank confirming that the account belongs to you or a cancelled cheque.

The benefit will be paid once assessed and the claim is accepted as valid.

Claims

If you are not satisfied with the outcome of your claim follow the appeal process provided below.

Complaints continuation process:

Step 1

Should you have a complaint or wish to dispute the outcome of your claim, please use the option below to register a complaint.

Contact details:

Tel: 0860 123 777 or +27 (0) 10 085 3820

Fax: +27 (0) 11 644 4400

Email: [email protected]

PPS will then endeavour to resolve the complaint and supply a response within 8 working days from date of acknowledgement of the request.

Step 2

You may submit a detailed written appeal to our Independent Internal Arbitrator, Jeff Mc Key, only if you have followed the appeal process and have been unsuccessful in appealing the decision as stated above. Contact details as follows: email: [email protected] or 011 644 4407.

Step 3

If the complaint is not resolved to your satisfaction after following step 1 and 2 above, you can refer the matter to the National Financial Ombud Scheme SA, details provided below.

Note: Step 1 and 2 should be followed prior to submitting an appeal to the National Financial Ombud Scheme SA

as their office will refer the matter back to PPS as a ‘Transfer’ matter if the process has not been followed.

National Financial Ombud Scheme SA

Telephone: 0860 800 900

Email: [email protected]

Website: www.nfosa.co.za

Physical Address (JHB):

110 Oxford Road,

Houghton Estate,

Illovo,

Johannesburg,

2198

Physical Address (CPT):

Claremont Central Building,

6th Floor,

6 Vineyard Road,

Claremont,

7708

In terms of the Prescription Act, you have three years from the date on which a final decision has been communicated to you, to institute legal action. The prescription period will only commence after all PPS review processes have been exhausted, which may include the periods of appeal to the Independent Internal Arbitrator and the National Financial Ombud Scheme SA.

Should you require any further assistance please contact PPS on e-mail [email protected] or call us directly on telephone 0860 123 777 (international: +27 10 085 3820) and we will gladly assist you.

Claims

No, it will not affect either.

Claims

Claims for benefits in terms of the PPS Provider Policy should be submitted as soon as possible after the occurrence of the event that gave rise to the claim in order to ensure efficient claims processing. For on-going claims, claim forms should be submitted on a monthly basis, signed and submitted on the 25th of each month.

Claims

All documents, irrespective of the content, are handled as confidential. You can however advise PPS on your claim form to keep your accredited PPS financial advisor informed. This does require your specific consent. If no consent is received, your financial advisor will not be informed regarding the progress of your claim.

Claims

Fully completed claim forms may be sent to [email protected].

Claims

You will be required to pay for the completion of the Declaration by Doctor Form. Some practitioners may require payment for the completion of this form. PPS will pay for any additional reports requested by us from your doctor.

Claims

Yes, you will be notified via email, phone or fax according to your preferred method of communication.

Claims

Possibly. Additional information may be requested from you or your (or spouse or child) treating doctor once assessed by a claims assessor, especially if the claim period exceeds the number of days the illness is expected to last or with particular conditions claimed.

Claims

Approved Medical Practitioners must have a minimum qualification of the following:

- BCh - Bachelor of Surgery

- BChir - Bachelor of Surgery

- BM - Bachelor of Medicine

- BS - Bachelor of Surgery

- ChB - Bachelor of Surgery

- DCh - Doctor of Surgery

- DS - Doctor of Surgery

- MBBCh - Bachelor of Medicine and Bachelor of Surgery

- MBBS - Bachelor of Medicine and Bachelor of Surgery

- MBChB - Bachelor of Medicine and Bachelor of Surgery

- MD - Doctor of Medicine

- BDS - Bachelor of Dental Surgery

- BChD - Bachelor of Dental Surgery

- DDS - Doctor of Dental Surgery

- DMD - Doctor of Dental Medicine

Claims

A Medical Practitioner registered with the Health Professions Council of SA (HPCSA) or equivalent medical body outside RSA, and approved by PPS.

A Dental Practitioner registered with the Health Professions Council of SA (HPCSA) or equivalent medical body outside RSA, and approved by PPS for dental related claims.

Claims

You can send an email to [email protected] to request claim forms.

Ask your broker to assist.

Alternatively, all the claim forms are available at https://www.pps.co.za/claims, under each product tab.

https://www.pps.co.za/faqs/all