Mutuality Video Title

WHY MUTUALITY MATTERS

PPS members come from versatile and diverse professions. However, knowledge is only part of their success. In a world where the human touch is often lost, would you not rather be insured with a company that cares about your well-being?

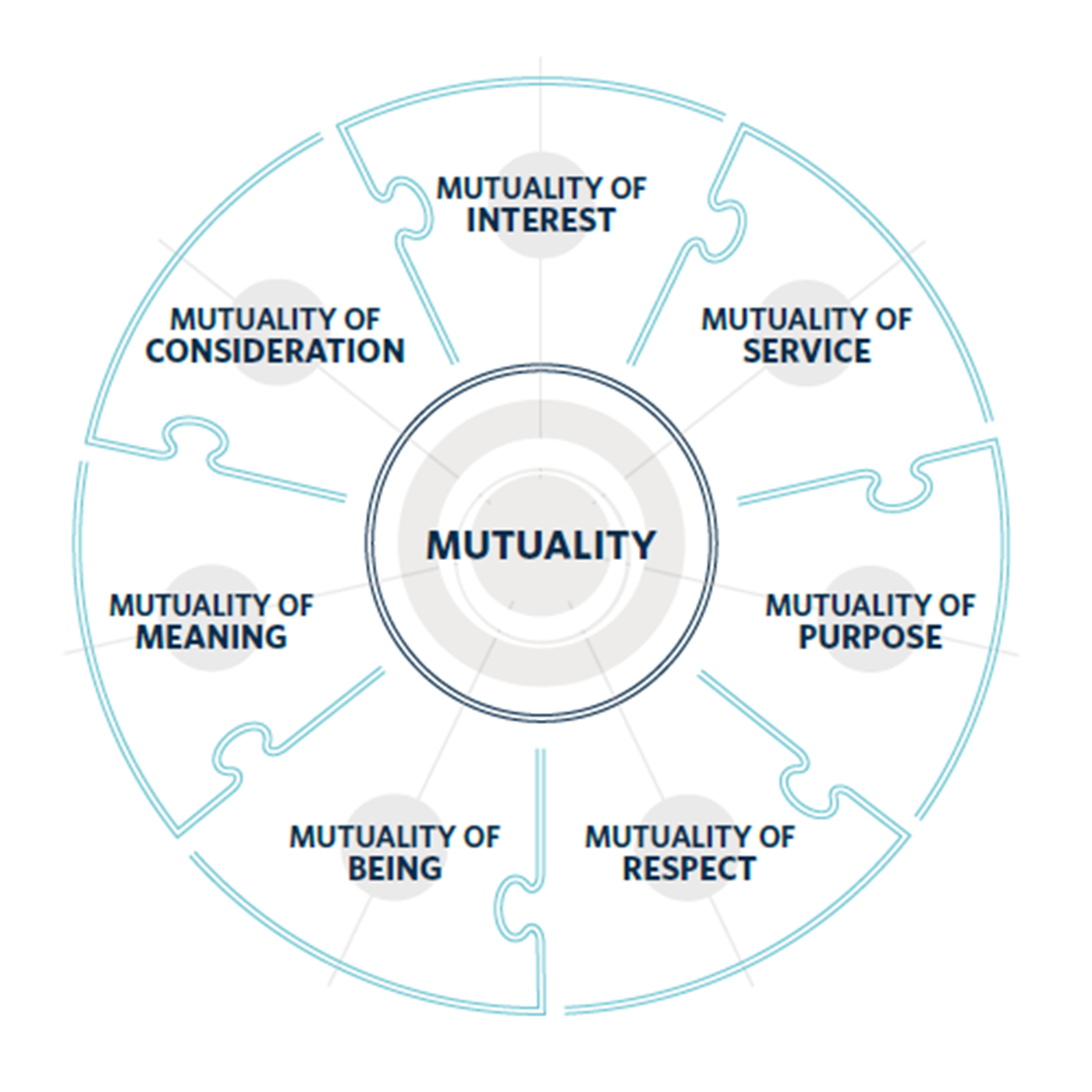

SPIRIT OF MUTUALITY

PPS was founded by a group of dentists who realised that if any of them were to suffer from an illness that kept them from work, their earnings could be severely affected. To protect themselves, they started a society where everybody contributed. These funds would be used to help any member through a period of illness. With this shared value, PPS soon grew to include other like-minded professionals.

OUR ETHOS

Although this model is very popular in the developed world, it is a rarely used model in financial services in South Africa today. Mutuality is what defines us at PPS. It refers to our origins where graduate professionals worked together to protect every member’s financial future.

PPS PROFIT-SHARE ACCOUNT™

Once a graduate professional becomes a member with qualifying products, a notional PPS Profit-Share Account™ is automatically opened in their name.

Every year, after announcing our annual financial results, operating and investment returns generated by PPS, following the deduction of expenses and the retention of funds as required by regulatory standards, are then allocated to the members' respective notional PPS Profit-Share Accounts™, irrespective of claims they may submit. Download Infographic.

VESTED PPS PROFIT-SHARE ACCOUNT™

After 60, the profits you have accumulated through the PPS Profit-Share Account™ over the course of your PPS membership may become available via the Vested PPS Profit-Share Account™. You can use your accumulated profits in the Vested PPS Profit-Share Account™ as part of your retirement planning.

Supplement your post-retirement income by combining regular withdrawals from your Vested PPS Profit-Share Account™ with PPS Living Annuity income payments, allowing your annuity capital to last longer.

HOW THE PPS PROFIT-SHARE ACCOUNT™ WORKS

Accumulation phase (before 55)

Pre-retirement phase (55 to retirement)

Post-retirement phase (upon retirement, from 60)

Read more below

Accumulation phase (before 55)

Choose between premiums: either one that remains the same for the duration of your policy or one that escalates following your birthday.

Pre-retirement phase (55 to retirement)

Choose between cover that stops when you turn 60, 65, 70 or that continues for as long as you continue to work.

Post-retirement phase (upon retirement, from 60)

Choose between benefits that start paying after you are booked off for either seven or 30 days.

Mutuality Accordion Title

Real examples of active policies:

Total premiums paid

R1 403 777.74

Total claims paid

R436 615.55

PPS Profit-Share Account™ balance

R1 492 553.19

Total premiums paid

R1 586 250.72

Total claims paid

R89 086.4

PPS Profit-Share Account™ balance

R1 655 660.46

Total premiums paid

R2 121 245.88

Total claims paid

R79 858.2

PPS Profit-Share Account™ balance

R2 733 970.47

Total premiums paid

R1 107 938.05

Total claims paid

R339 505.05

PPS Profit-Share Account™ balance

R1 547 272.44

https://www.pps.co.za/about/mutuality