PPS: Your partner in cross-solutioning

While acquiring new clients is essential to growing your business, you should not forget about another potential source of income – your existing clientele. Your current clients know and trust you.

Acquiring new customers is one of the most expensive aspects of a business relationship. Therefore, it stands to reason that introducing existing customers to a broader suite of products makes a lot of sense. This can help increase retention while demonstrating the long-term value PPS offers members.

Cross-selling is difficult. It can feel awkward or uncomfortable and it is not for the thin-skinned. This is because customers do not generally take kindly to it. They perceive it as an attempt to get more money out of them.

At PPS, we prefer the term cross-solutioning. We do not just want to sell our members “just another product”. We want to present the full range of financial solutions we have available, ensuring their long-term financial well-being.

Benefits of cross-solutioning

- Relationships: Marketing to existing customers takes less effort as you already have a relationship with them, and they trust you;

- Ring-fence your clients: It can help you to improve retention and ring-fence your clients if you can offer them solutions across the board;

- Reputation and brand: You can grow your brand as a financial services expert, building loyalty.

How to cross-solution effectively and increase growth

While cross-solutioning remains essential to your business’s success, there are right and wrong ways to do it. Below are some tips on how to go about this successfully:

- Approach the right clients: Analyse your client profiles and identify candidates you can offer a range of solutions. There is no one-size-fits-all approach; sometimes, it might be detrimental to offer various solutions.

- Stay close to your clients: Know what is going on in your clients’ lives. Follow their life events to introduce relevant products – major life events can include buying a house, getting married, changing occupations or getting a promotion at work. People are also more open to discussing their future and protection at this point.

- Look through the client’s lens: Individuals who manage to cross-solution effectively, build a customer-centric view of opportunity and take a longer-term view of customer value.

- Look for “by the way” opportunities: For example, when a client takes out insurance for their new home, it might be worthwhile to enquire if they have comprehensive insurance for their car, business or their income. If not immediately, then at the next policy review date. Planting this seed can create more opportunities at a later stage.

- Help customers visualise the future: Create value for your clients by helping them see new possibilities, looking at the future differently and changing their behaviour accordingly.

Why partner with PPS?

Cross-solutioning has become a strategic priority for many financial services providers. Recognising this, PPS has, over the years, grown from only providing sickness and permanent incapacity benefits to also providing lump-sum benefits, investments and short-term insurance, financial planning, fiduciary services and professional indemnity for members in the healthcare professions. Qualifying members can also, via Profmed, have access to medical aid.

Click here for more information.

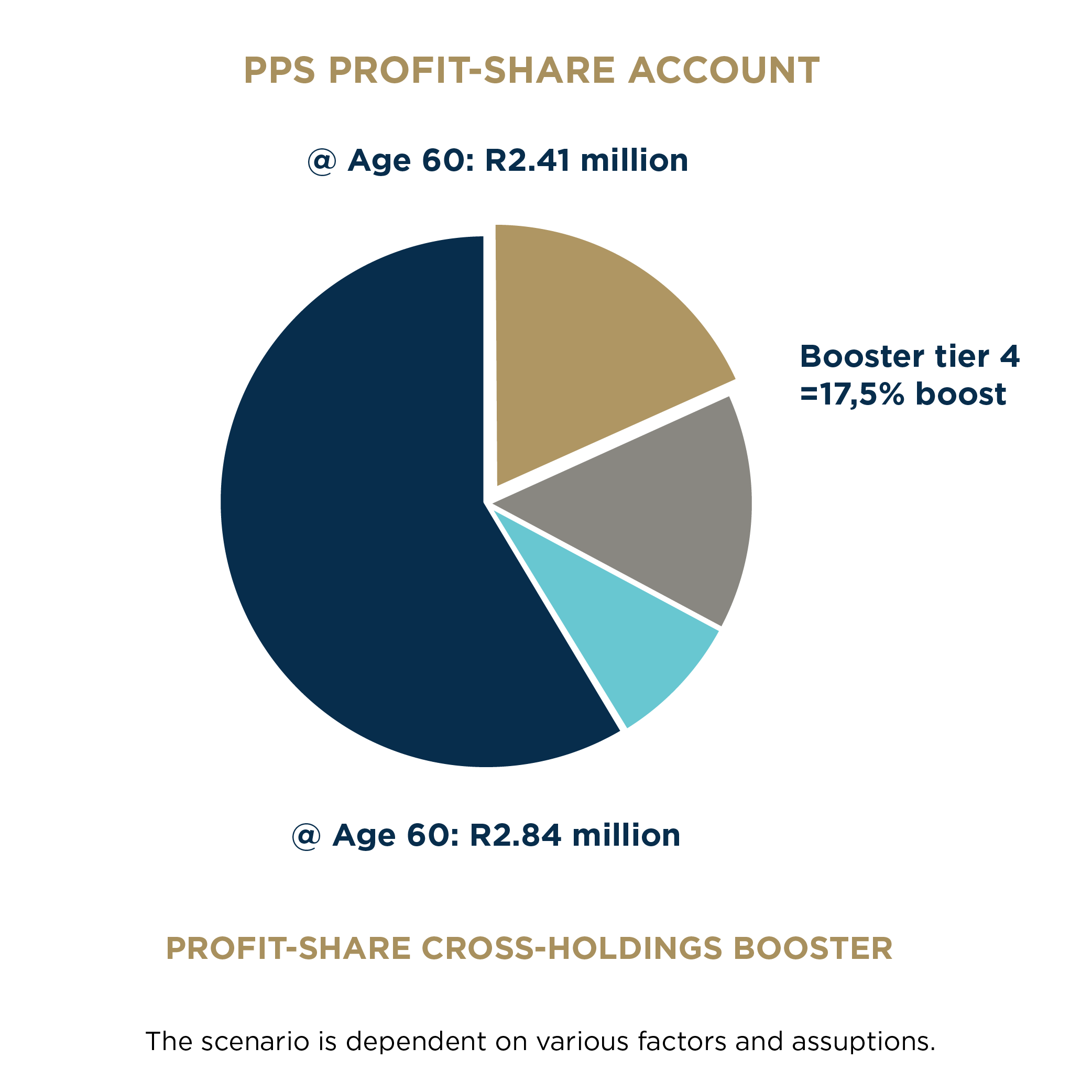

To add to this, not only do members with a life-risk product earn Profit-Share but they can also earn additional profit allocations by having products with other PPS subsidiaries and affiliates. Members will receive profit allocations from their qualifying products. After that, their Profit-Share Account will be boosted, with the PPS Profit-Share Cross-Holdings Booster, depending on the number of qualifying products they have from the subsidiary or affiliate companies.

PPS is there for you and your clients through every stage of their life. Creating value and protecting their dreams so that they can live the lives they want to live.

Click here to view the PPS Profit-Share Cross-Holdings Booster brochure.

By Motshabi Nomvethe, Head of Technical Marketing

The PPS Profit-Share Cross-Holdings Booster is tiered according to the number of products a member holds across subsidiaries and affiliates. If they hold a PPS Life Risk product and they take up a qualifying product(s) from a PPS subsidiary/affiliate (PPS Short-Term insurance, Profmed and/or PPS Investments) it will increase their allocation.

The Booster allocations are not fixed and can differ each year. Allocations take place annually and will be declared with Profit-Share. The amounts are dependent on the profitability of PPS and its subsidiary/affiliates products. PPS reserves the right to discontinue this offering at its own discretion.

Past performance is not necessarily indicative of future performance.

PPS is a licensed insurer conducting life insurance business, a licensed controlling company and an authorised FSP.

Business Brief Articles

https://www.pps.co.za/business-brief/pps-your-partner-cross-solutioning