Leverage the looming two-pot system to boost your retirement savings

The COVID-19 pandemic has been unprecedented and affected people’s lives worldwide. We have seen its impact on businesses, particularly small to medium enterprises, and how it has forced them to make difficult decisions, such as retrenching employees. This has placed many people in a dire financial situation, often leading them to consider dipping into their retirement funds – the largest source of savings for most South Africans – to make ends meet.

National Treasury noted this and, in 2021, proposed to change the retirement fund system and introduce the “two-pot system” as part of its Draft Revenue Laws Amendment Bill. Implementation is set for 1 March 2024. Should this Bill be implemented, people will be able to access their accumulated savings without having to resign from their current employer and incur punitive taxes, which can delay their retirement savings goals. It will also allow people to invest a third of their pension and provident funds in a savings portion – including retirement annuities – that would have ordinarily been accessible at age 55.

Turning a retirement savings crisis into an opportunity to bolster a savings culture

It is evident that many South Africans are not saving adequately for retirement, given that average replacement ratios are between 25-30%. This is because many people sometimes pause retirement savings during their working lives. Some are not part of employer-sponsored retirement schemes that act as a “forced saving mechanism”, while many other South Africans do not have the means to prioritise saving for retirement.

For those who want to bolster their retirement savings, the change in legislation to the two-pot system should be used as a golden opportunity to do so. Here are three starting points to consider:

1. Invest in a diversified portfolio that takes life stages into account

The general rule is the younger an individual is when they start to invest, the more risk they should take. If they are getting closer to retirement, however, they should reduce their risk, as they may not have the time to endure significant market downturns.

Constructing a portfolio under the two-pot system will still require selecting one in line with the 2022 Draft Revenue Laws Amendment Bill Regulation 28. Pension and provident funds will need default options for your clients who cannot choose their investment portfolios. In the case of kickstarting retirement savings through a retirement annuity, a client should consider multi-asset funds. At PPS Investments, we offer an extensive range of multi-manager and single-managed partnership funds that follow an investment process that provides diversification among underlying managers. This has led to competitive performance over the long term, even as market volatility has recently increased.

2. Optimise savings in the short term by making sound financial decisions now

There might be some of your clients who are changing jobs and may fear that once the two-pot system kicks in, a large portion of their retirement savings will be locked in the two-thirds pot that vests only at retirement and feel it might be better to withdraw it now before the new legislation comes to effect.

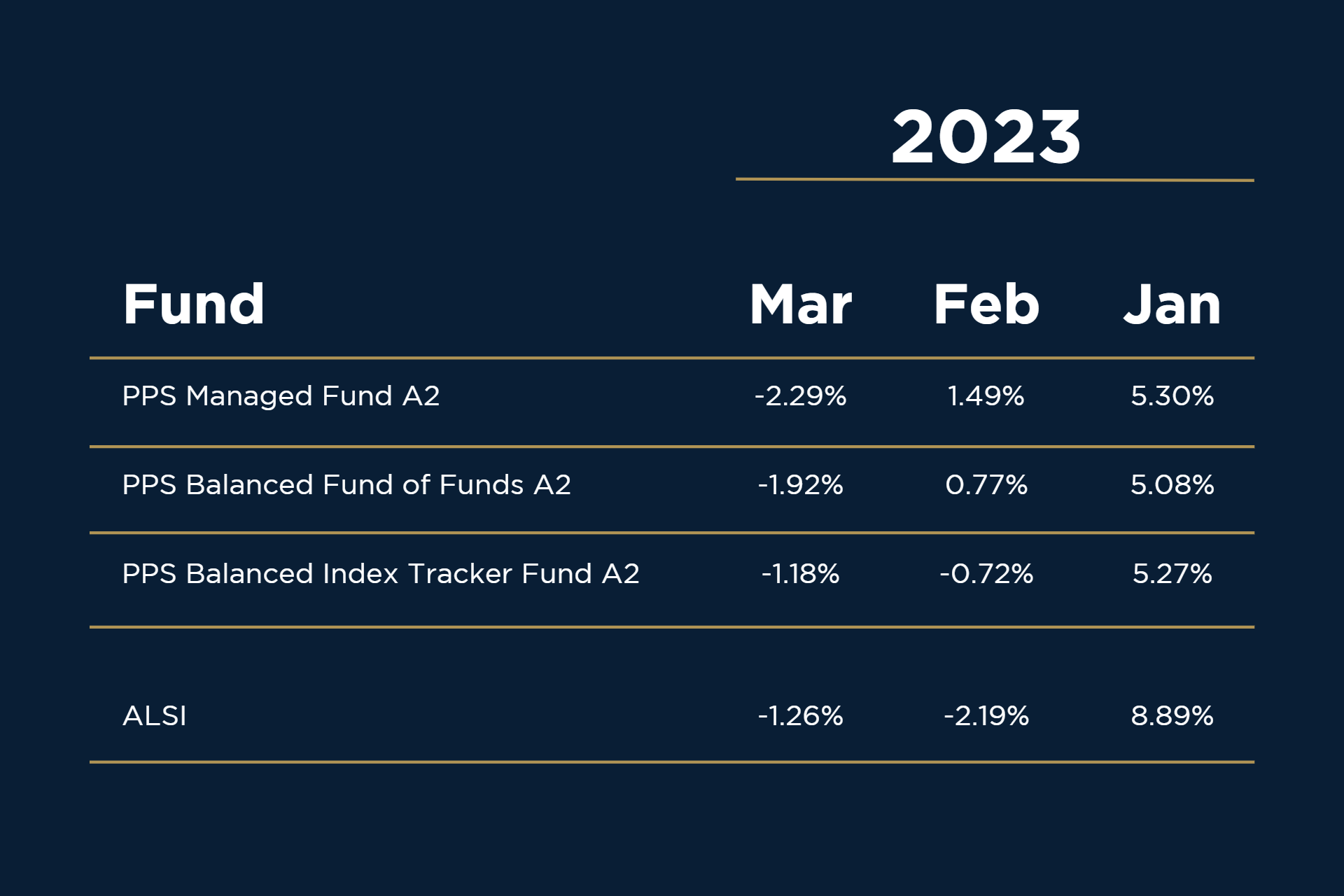

While people have different financial circumstances, transferring the funds, where possible, into a preservation fund would be worthwhile, as taxes can be high if they withdraw any amount above R27 500. Once the two-pot system is effective, individuals will be able to make withdrawals from the savings pot on a rolling basis every 12 months, which will be taxed at their marginal tax rate. Preserving their investment gives them accumulated savings and an opportunity to grow. I know this from my own experience when I recently changed jobs and preserved my pension fund. This happened in January 2023. The transfer was finalised the following month, which meant being out of the market for a month. February 2023 was a “good” month in the market as the FTSE/JSE ALSI yielded 8.89% in January 2023. I could have also earned upwards of 5% had I been invested in any of the PPS Multi-Asset High Equity Funds. The diagram below illustrates what I missed out on in January.

Source: Morningstar, 31 March 2023

While this is a recommended approach, it does not constitute financial advice. Speak to a professional financial adviser who can provide you with a solution that is fit for purpose.

3. Maximise the time in the market and be mindful of fees

The key advantage of the two-pot system is that people will have access to making provisions for short-term financial emergencies while staying the course in saving for retirement. The proposed amendments stipulate that any accumulated savings until March 2024 will remain in the vested pot and be accessible based on the fund rules that still apply now.

It makes sense to optimise the growth of that investment by taking advantage of the tax deductions you get when saving through a retirement fund. The government provides a tax-deductible saving of up to 27.5% of an individual’s income, which is capped at R350 000 as a rand value before the end of each tax year.

At PPS Investments, we provide clients’ family members with an opportunity to invest with us, pooling the value of investments to reduce the administration fees they would pay, allowing their investments to accumulate more growth. The most important thing for your clients to do is to stay the course and do time in the market, as investments need a long-term orientation.

By Nkululeko Kunene, Institutional Client Manager at PPS Investments

PPS Investments Group is a subsidiary of Professional Provident Society Insurance Company Limited (PPS), a licensed insurer conducting life insurance business, a licensed controlling company and an authorised FSP. PPS Investments Group consists of the following authorised Financial Services Providers: PPS Investments (Pty) Ltd (“PPSI”), PPS Multi-Managers (Pty) Ltd (“PPSMM”) and PPS Investment Administrators (Pty) Ltd (“PPSIA”); and includes the following approved Management Company under the Collective Investment Schemes Control Act: PPS Management Company (RF) (Pty) Ltd (“PPS Manco”). Financial services may be provided by representative(s) rendering financial services under supervision.

Disclaimer: Kindly note that this does not constitute financial advice the information provided is purely informational. In terms of the Financial Advisory and Intermediary Services Act an FSP should not provide advice to investors without an appropriate risk analysis and thorough examination of a client’s particular financial situation. The information, opinions and communication from the PPS Group or any of its subsidiaries, whether written, oral or implied are expressed in good faith and not intended as investment advice, neither do they constitute an offer or solicitation in any manner.

Business Brief Articles

https://www.pps.co.za/business-brief/leverage-looming-two-pot-system-boost-your-retirement-savings