Article Name

SA STUDENTS CONCERNED ABOUT LIFE AFTER GRADUATION

Published: October 11, 2023

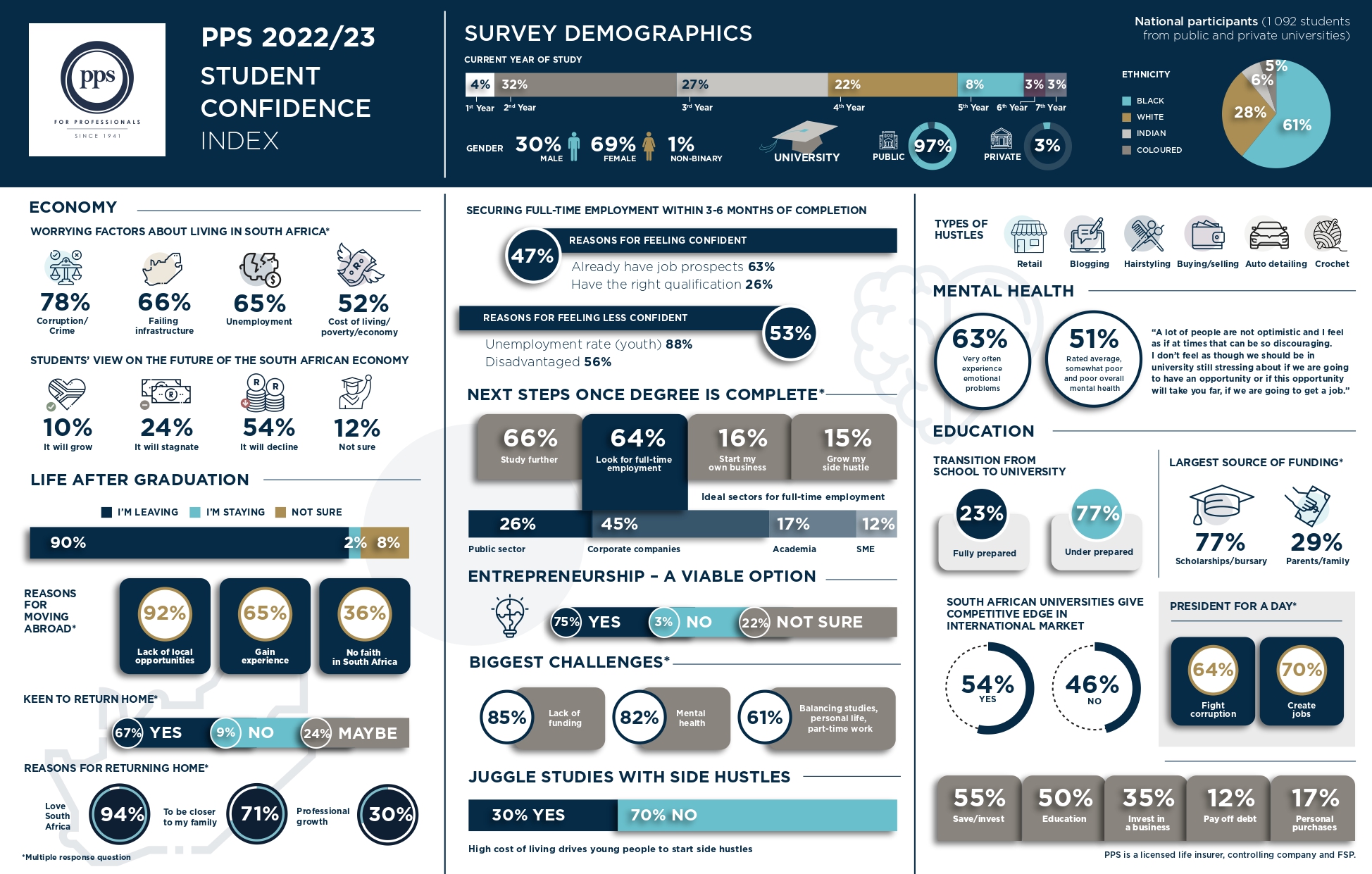

2022/2023 PPS Student Confidence Index highlights:

• 90% desire to work and live abroad to gain experience

• 67% would consider returning from abroad to contribute to the economy

• 75% consider entrepreneurship a viable option

• 53% not confident they would find employment within three to 6 months

• 30% juggle their studies with side hustles

• 77% rely on scholarships and bursaries to acquire degrees

Johannesburg, 5 October 2023 – The overarching concern for students in the 2022/23 PPS Student Confidence Index was what “Life after graduation” would mean for their career prospects amid the worrying economic climate, unemployment, the ever-rising cost of living and the lack of local opportunities available to them. This has prompted an overwhelming desire to live and work abroad to gain experience and enhance their chances of providing a better-quality future for their families.

In line with 2021, their love for South Africa and their families after working abroad would be key drivers that would motivate them to return home and use their experience and skills to contribute to the country's growth.

“Their priority is to find meaningful and financially rewarding employment in their chosen profession and to carve a niche for themselves that propels them out of debt towards financial independence. For some, this remains a challenge as being the first in the family to graduate brings with it the added family pressure to secure employment and deliver a return on their investment immediately,” says Motshabi Nomvethe, PPS Head of Technical Marketing.

This year's key trend was the increase in emotional struggles due to the pressures of university workload.

On the educational funding front, scholarships and bursaries were the biggest funding sources, accounting for over three-quarters (77%) of participating university students. Participants said that access to scholarships and bursary funding, selecting a field of study they were passionate about, and the high standard of education at South African universities were enablers of their “Life after graduation” journey. The majority believed that a South African degree still carried weight and provided a competitive edge in the global market.

The survey has been conducted annually since 2015 (except in 2020 due to COVID-19). The 2022/23 survey involved over 2 400 participants and was conducted by the Professional Provident Society (PPS), the financial services company focused solely on providing intelligent financial solutions for graduate professionals.

The students who participated are undergraduates and postgraduates studying at a public or private university towards a profession-specific degree such as engineering (civil, chemical, securing & network), medicine, law, accounting, business management and psychology. The survey was administered online, and virtual and face-to-face focus groups were also conducted.

Of the participants, 78% rated crime and corruption as the topmost worrying factors about living in South Africa, with 65% citing unemployment, 66% the failing infrastructure and 52% the cost of living/poverty and the economy.

The desire of students, especially among younger black students, to live and work overseas jumped to 90% (compared with 39% in 2021), with the majority citing a lack of local opportunities and the hope that the overseas market will allow them to gain experience in their profession. However, financial resources are a key barrier to moving abroad and some feel there are still some local opportunities.

When it comes to their job prospects and the likelihood of finding employment within three to six months after finishing their degree, 53% of students felt unsure. This is slightly lower than the 2021 results, which showed 55% were uncertain. Out of those who lacked confidence, 88% believed the reason was the high rate of young people without jobs, and 57% thought they were at a disadvantage because they didn't have good connections and, at times, couldn't access the resources needed for job applications and interviews.

Three-quarters (75%) of students consider entrepreneurship a viable option for young South Africans. The interest in having multiple income streams continues to feature, with 30% saying they already have a side hustle. “I feel as though, with the economy that we live in, side hustles are so essential,” explained one student. Half of the participating students indicated that they were planning to start a side hustle within a year.

Most students want to study further (66%) or look for a full-time job (64%). Nearly three quarters (73%) in the 18 to 21 age category and 74% of Black students are interested in studying further, while 73% of those aged 22 and older would prefer to seek full-time employment. Overall, large corporates are the most attractive employer (45%), followed by the public sector and state-owned companies (26%).

Emotional struggles among university students increased dramatically, with nearly two-thirds (63%) having experienced problems with their work or daily life in the past year. Employment prospects are a cause for concern, and there is overt and subtle pressure from family, peers, and social media to succeed. Furthermore, some students continue to experience challenges regarding access to basic needs such as food and affordable accommodation close to their learning institution. “A lot of people are not optimistic, and I feel as if, at times, that can be so discouraging. I don’t feel as though we should be in university still stressing about if we are going to have an opportunity or if this opportunity will take you far if we are going to get a job,” adds one student.

“What is deeply concerning is that although students are aware of the support resources available to them, they are turning to substance abuse such as alcohol and drugs as coping mechanisms to study and deal with financial pressures and life’s demands,” adds Nomvethe.

• A quarter felt they were emotionally and mentally unprepared to deal with the pressures of university workload and how to effectively manage their time when they transitioned from high school to university, thus leaving 77% of students calling for more to be done through school programmes to better equip them with the necessary skills.

• While workplace programmes are needed to gain experience before completing their studies, 63% of students have not participated in work readiness programmes.

Regarding finances, three-quarters believed they have a strong understanding of savings and budgeting, with 51% indicating knowledge of investing. When asked what they would do if given R50 000, half would invest it in their education, 47% said they would save the money, and 34% would start a business.

“The strong message from students to future employers and government is to invest in young graduates, make funding for post-graduate studies accessible and create and enable employment so that they have the confidence in South Africa’s future to contribute their knowledge and skills at home,” concludes Nomvethe.

Disclaimer: Kindly note that this does not constitute financial advice, and the information provided is included for illustrative purposes. In terms of the Financial Advisory and Intermediary Services Act (FAIS Act), an FSP should not provide advice to investors without an appropriate risk analysis and thorough examination of a client’s particular financial situation. The information, opinions, and communication from PPS or any of its subsidiaries, whether written, oral, or implied are expressed in good faith and not intended as investment advice, neither do they constitute an offer or solicitation in any manner. Professional Provident Society Insurance Company Limited is a licensed insurer conducting life insurance business, a licensed controlling company, and an authorised financial services provider.

https://www.pps.co.za/sa-students-concerned-about-life-after-graduation