PPS Managed Fund is nominated for a 2024 Raging Bull Award

We are proud to announce that the PPS Managed Fund, managed by 36ONE Asset Management (36ONE) has been nominated for a Raging Bull Award for Risk-adjusted performance over five years. The fund has outperformed the CPI + 5% benchmark by 2.2% and the average of its peers in its ASISA category by 3.9% per annum since inception. This is an incredible achievement and a true testament to the hard work and dedication of the team.

36ONE’s experience in managing hedge funds and flexible approach to investing is its key differentiator. As a style agnostic manager, their robust investment approach and ability to quickly respond to changing markets provides the agility needed to take advantage of economic opportunities during periods of market volatility.

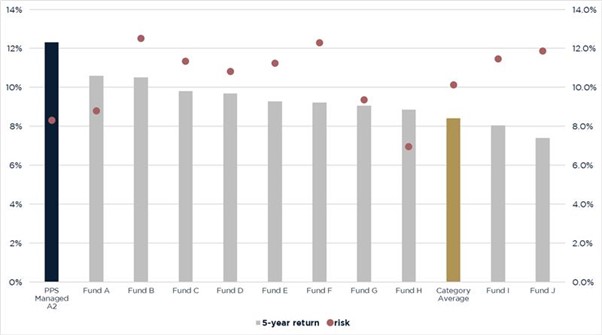

PPS Managed Fund: Strong risk-adjusted returns

Source: Morningstar |As at 29 February 2024

This chart compares the 5-year performance of the PPS Managed Fund against the 10 largest funds in the category. As you can see, the fund delivered strong performance while maintaining lower risk compared to peers. A testimony to the rigorous and thorough investment process.

We are proud to be partnering with 36ONE, whose values are closely aligned with our focus on the creation and management of intergenerational wealth, we strive to enhance the financial well-being of our member community and promote their prosperity through shared success.

---

PPS Investments Group is a subsidiary of Professional Provident Society Insurance Company Limited, a Licensed Insurer and Financial Services Provider. PPS Investments Group consists of the following authorised Financial Services Providers: PPS Investments (Pty) Ltd(“PPSI”), PPS Multi-Managers (Pty) Ltd(“PPSMM”) and PPS Investment Administrators (Pty) Ltd(“PPSIA”); and includes the following approved Management Company under the Collective Investment Schemes Control Act: PPS Management Company (RF) (Pty) Ltd (“PPS Manco”). Financial services may be provided by representative(s) rendering financial services under supervision. www.pps.co.za/invest. Collective Investment Schemes in Securities (CIS) are generally medium-to long-term investments. The value of participatory interests (units) may go down as well as up, and past performance is not necessarily a guide to future performance. The manager does not provide any guarantee either in respect of the capital or the return of a portfolio. Annualised performance is the average return earned on an investment each year over a given time period.

This fund is exposed to foreign securities and as such, it may be subject to the macroeconomic, settlement risks and political risks brought about by this exposure. It may also be subject to currency risk, which means the underlying investments of the fund could depreciate or appreciate against the reporting currency of the investor. Collective Investment Schemes in Securities (CIS) are generally medium-to long-term investments. The value of participatory interests (units) may go down as well as up, and past performance is not necessarily a guide to future performance. The manager does not provide any guarantee either in respect of the capital or the return of a portfolio. Annualised performance is the average return earned on an investment each year over a given time period.

This fund is exposed to foreign securities and as such, it may be subject to the macroeconomic, settlement risks and political risks brought about by this exposure. It may also be subject to currency risk, which means the underlying investments of the fund could depreciate or appreciate against the reporting currency of the investor.

36ONE Asset Management (Pty) Ltd, an Authorised Financial Services Provider. FSP# 19107.

Backhttps://www.pps.co.za/pps-managed-fund-nominated-2024-raging-bull-award