Article Name

Perspective on the global macro environment - May 2022

Published: July 28, 2022

Investors experienced one of the best years on record in 2021 as indices across the world soared to record highs. Moving into 2022, there was a general sense of cautious optimism. Inflation, while elevated, was deemed likely to be transitory and supply chain constraints were finally starting to ease.

Russia’s invasion of Ukraine in February caused a global shock with equities declining and bond yields rising (meaning prices fell). Commodity prices soared with Russia being a key producer of oil, gas, and wheat. This contributed to a further surge in inflation, as well as supply chain disruption. Chinese equities were negatively affected by renewed COVID-19 outbreaks, leading to stringent lockdowns in some major cities, shutting down production centres for lengthy periods of time.

At the end of April 2022, inflation in many countries has increased by between 200% - 400% over the previous 12 months (shown in the graph). This has forced the US Federal Reserve (US Fed), along with central banks worldwide, to drastically increase rates to combat high inflation, even as global economic growth softens.

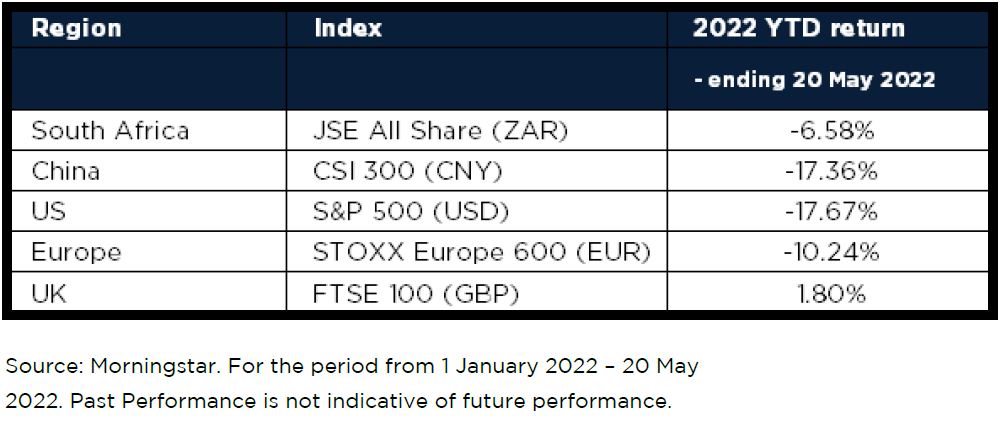

As a result of these factors, global equity markets have been under pressure this year, as shown in the table. Soaring commodity prices has softened the blow on some of the net commodity exporters in the Middle East, South America and Africa, however most investors have little to no exposure to these markets in their global equity allocation.

Looking ahead

As we look ahead to 2023, we share some of the key factors that could have an impact on your portfolio.

Financial markets continue to look beyond the global pandemic but now face an uncertain outlook because of a potential inflationary shock and slower economic growth.

Inflation remains a tale of two stories; inflation is likely to be higher, broader, and more persistent through 2023 but should decline to more ‘normalised’ levels over the longer term driven by structural disinflationary forces.

Monetary policy is changing, and the interest rate outlook is now more hawkish than previously expected to address both rising actual inflation but also elevated longer-term inflation expectations.

Bond market yield curves are flattening rapidly, and in some cases already modestly inverted – a possible precursor to an economic slowdown or recession. Short-term interest rates and longer-term bond yields are expected to move from extraordinary low levels to more ‘normal’ levels in a historical context.

Equity market leadership could broaden in 2022 and beyond versus the narrow-driven markets of the previous few years. Thoughtful analysis is required to determine the longer-term implications of potentially higher and persistent inflation, a rising rate environment and slower growth on long-term equity market leadership going forward.

PPS house view

From a house view tactical asset allocation perspective, we have long been overweight global equity and global property, and underweight bonds, but in April we became more cautious on growth assets, given the continued deterioration in global macro conditions. We are at an inflection point in the global macro cycle, with growth now decelerating.

Global bonds, which typically do not respond well to rising inflation and interest rates, have experienced their worst sell-off in decades, because of tightening financial conditions. With interest rates still at relatively low levels, the challenge is that there is scope to move much higher to revert to normal levels. This comes at a time when the US Fed is ending its asset purchase program (quantitative easing), which has directly supported the bond market (as well as equity markets indirectly) for over a decade.

It remains to be seen whether this is merely a mid-cycle slowdown or the onset of a global recession, but regardless, conditions no longer warrant being overweight growth assets, which are not particularly cheap. We therefore downgraded both global equity and property to an underweight, and narrowed the global bond underweight, while becoming slightly more constructive on cash. These changes will be implemented in our multi-manager fund range.

Disclaimer: The information, opinions and any communication from PPS Investments Group, whether written, oral or implied are expressed in good faith and not intended as investment advice, neither does it constitute an offer or solicitation in any manner. Furthermore, all information provided is of a general nature with no regard to the specific investment objectives, financial situation or particular needs of any person. It is recommended that investors first obtain appropriate legal, tax, investment or other professional advice prior to acting upon such information.

PPS Investments Group is a subsidiary of Professional Provident Society Insurance Company Limited, a Licensed Insurer and Financial Services Provider. PPS Investments Group consists of the following authorised Financial Services Providers: PPS Investments (Pty) Ltd (“PPSI”), PPS Multi-Managers (Pty) Ltd (“PPSMM”) and PPS Investment Administrators (Pty) Ltd (“PPSIA”); and includes the following approved Management Company under the Collective Investment Schemes Control Act: PPS Management Company (RF) (Pty) Ltd (“PPS Manco”). Financial services may be provided by representative(s) rendering financial services under supervision. www.pps.co.za/invest

By Reza Hendrickse, Portfolio Manager

https://www.pps.co.za/perspective-global-macro-environment-may-2022