Investing to outpace inflation

When you save to reach your financial goals, particularly retirement, you hope that your investments will grow sufficiently to allow you to enjoy life down the road. However, inflation can have a significant impact on your ability to retire with comfort. If the returns you achieve during your accumulation period do not outpace inflation, your financial goals could be at risk.

What is inflation?

Inflation measures the decrease in purchasing power of any given currency. In South Africa, purchasing power is measured by using the Consumer Price Index (CPI). The CPI measures the annual increase in prices for a basket of everyday items. When the CPI rises, the rand loses value, and the cost of living becomes higher.

The South African Reserve Bank tries to keep inflation between 4% and 6% per year to protect and improve financial stability. While they have generally been successful at this task, there have been times where inflation has spiked for extended periods of time.

Combatting the impact of inflation

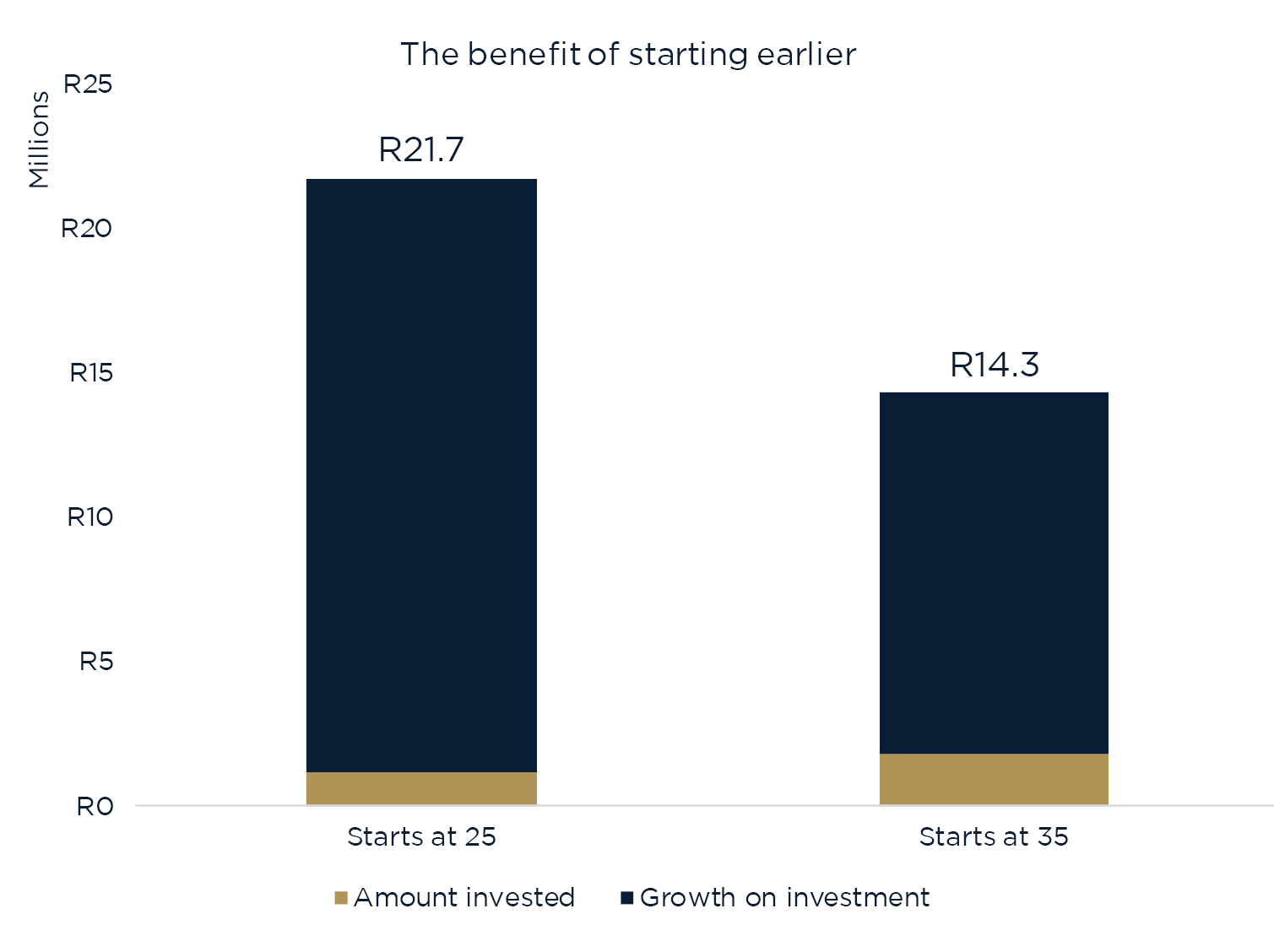

Saving habits and investing with the right partner are crucial for managing inflation and its impact on your investments. Graph 1 illustrates the importance of starting your investment journey as early as possible. In this scenario, two people are saving for retirement until the age of 65, both earning inflation + 5% on their investment. The early saver starts at age 25 investing R2 500 per month, while the late saver starts at age 35 and invests R5 000 per month until retirement. Despite the late saver investing more over time, the 10-year head start helped the early saver to retire with more than double the amount. Despite the late saver investing more over time, the 10-year head start helped the early saver to retire with more than R7 million ahead of the late starter.

Source: Morningstar, inflation assumed at 6.% p.a

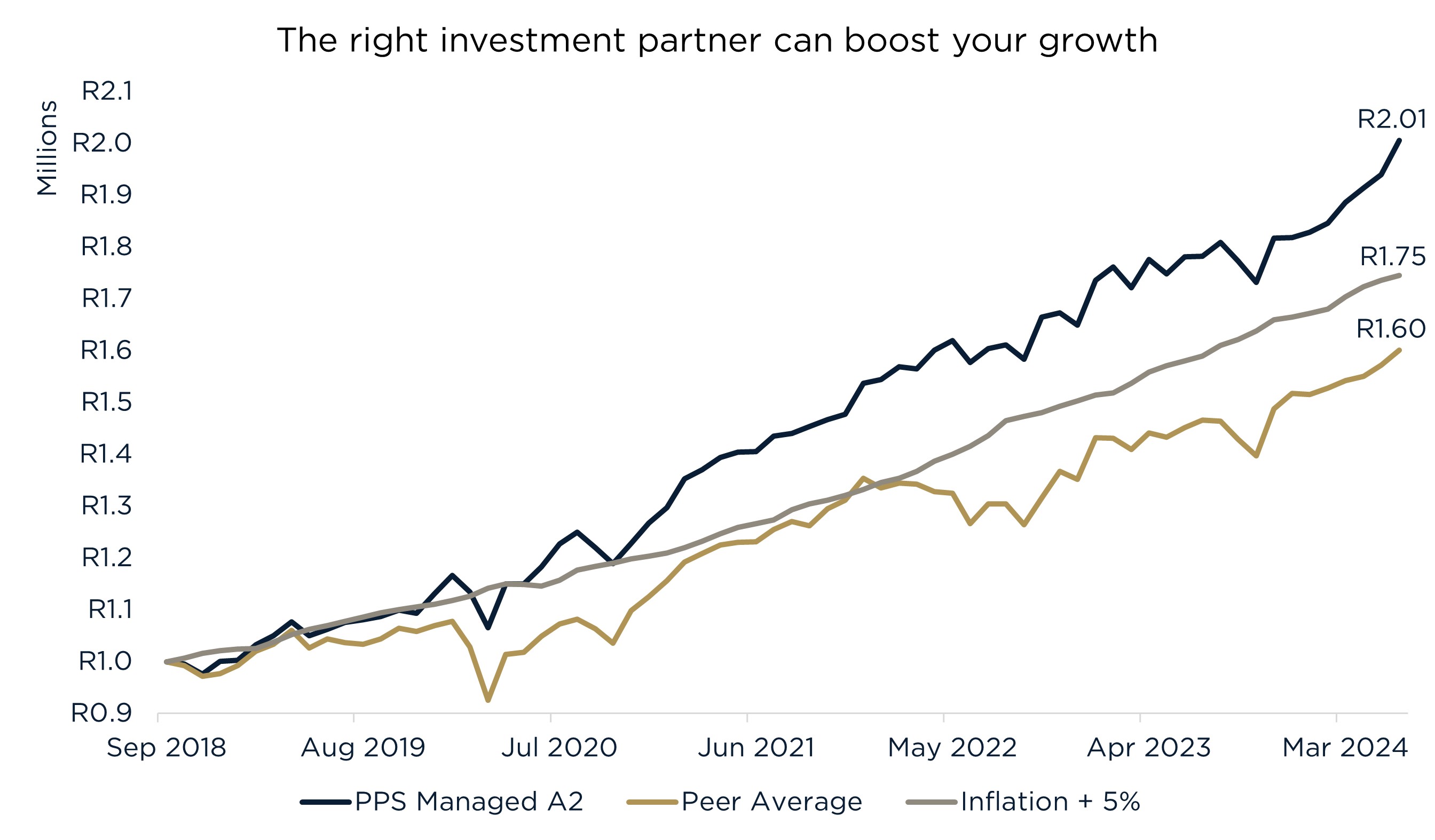

While it would be ideal to achieve a return of inflation + 5% on your investment of each year, this is simply not possible as you cannot invest in inflation. The importance of investing with the right partner is illustrated on Graph 2. Had you invested R1 million into the PPS Managed fund when in launched in 2018, your money would have doubled to just over R2 million. Easily outpacing the average fund in the ASISA SA MA High Equity category as well as inflation +5%.

Source: Morningstar

Through their rigorous investment process, the PPS Multi-Manager team strives to partner with the best managers from around the world. The PPS Managed fund, managed by 36ONE Asset Management, is just one of the many exceptional managers to form part of our investment offering.

Saving with purpose

PPS Investments provides its members additional benefits through the power of mutuality.

- Profit Share: Qualifying members can share in the profits of the business, further enhancing their retirement savings through the PPS Profit Share Account.

- Family Network: The Family Network offering helps families who save together to reduce their administrative fees, boosting the growth of their savings.

As a mutual, our primary goal is not only to help today’s professionals reach their financial goals, but also to develop future professionals. Through our Cultivating Tomorrow’s Professionals initiative and investing in education, PPS Investments is committed to empowering the next generation.

Start your savings journey today

July is National Savings Month, and there is no greater time or place to start your journey to financial independence. PPS Investments offers a wide range of investments and products designed to enable our members live the lives they want to live in a world worth living in. Speak to your financial adviser or reach out to our client services team to learn more.

Explore our fund offerings through our Multi-Manager and Partnership Fund ranges.

Email: [email protected]

Call: 0860 468 777 (0860 INV PPS) or (021) 672 2783

Collective Investment Schemes in Securities (CIS) are generally medium-to long-term investments. The value of participatory interests (units) may go down as well as up, and past performance is not necessarily a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and scrip lending up to 10% of the market value of the portfolio to bridge insufficient liquidity. A schedule of fees and charges and maximum commissions is available on request from the manager. A CIS may be closed to new investors in order for it to be managed more efficiently in accordance with its mandate. Performance has been calculated using net NAV to NAV numbers with income reinvested. Annualised performance is the average return earned on an investment each year over a given time period. The manager does not provide any guarantee either in respect of the capital or the return of a portfolio. Certain funds may be exposed to foreign securities and as such, may be subject to additional risks brought about by this exposure. The information, opinions and any communication from PPS Investments Group, whether written, oral or implied are expressed in good faith and not intended as investment advice, neither does it constitute an offer or solicitation in any manner. Furthermore, all information provided is of a general nature with no regard to the specific investment objectives, financial situation or particular needs of any person. It is recommended that investors first obtain appropriate legal, tax, investment or other professional advice prior to acting upon such information. PPS Investments Group is a subsidiary of Professional Provident Society Insurance Company Limited, a Licensed Insurer and Financial Services Provider. PPS Investments Group consists of the following authorised Financial Services Providers: PPS Investments (Pty) Ltd (PPSI), PPS Multi-Managers (Pty) Ltd (PPSMM) and PPS Investment Administrators (Pty) Ltd (PPSIA); and includes the following approved Management Company under the CISCA: PPS Management Company (RF) (Pty) Ltd (PPS Manco). Financial services may be provided by representative(s) rendering financial services under supervision. www.pps.co.za/invest.

Backhttps://www.pps.co.za/investing-outpace-inflation-0