Offshore exposure in retirement planning – is it for everyone?

Investing a portion of your portfolio offshore is prudent, but the exact amount will depend on your circumstances. Many in the wealth market are “internationalising” themselves. According to the African Wealth Report 2020, South African High Net Worth Individuals (HNWI) holds 20% of their wealth offshore, mainly through financial market exposure.

The current protracted political and economic uncertainty in South Africa cajoles investors to become emotionally driven, which should not be the case. Sensible geographic diversification is wise, but the reality is that how much will depend on the investor.

Here are three scenarios that I account for:

Scenario 1: Those who believe the grass is greener on the other side

In this instance, where clients plan to leave South Africa in the foreseeable future, I suggest they start moving all their liquid funds offshore as part of their annual offshore allowance and expose themselves to as much offshore as is allowed within their retirement products. Therefore, they would maximise the 30% Regulation 28 of the pension funds act allowance inside retirement funds and look at holding dual-listed stocks. This is because you want to start building and protecting your wealth in the currency that you will retire in or live off one day. It would, therefore, not have a significant impact if the Rand appreciates or depreciates, as your investments are domiciled in the currency that you will be retiring in.

Scenario 2: Wait and see

Clients who are unsure whether they will leave or stay in South Africa, could start exploring the benefits of dual citizenship, leaving such an option open for them anytime in the future. Regarding asset allocation and planning, these clients should typically have 50% of their assets offshore and 50% local – so that they hedge offsets in the movement of the currency.

Allocation does not need to be held per product but rather on a holistic portfolio level. For example, because you are limited to 30% offshore exposure in your retirement savings, you could diversify your discretionary investments more offshore to create a holistic portfolio allocation of around 50% offshore and 50% local. I do have clients who want their children to one day study overseas, so for them, we have increased the offshore exposure.

Scenario 3: #ImStaying

In this scenario, clients do not need to hedge the currency exposure. They are usually comfortable with the majority of their assets exposed to local investments and in Rand. Anything between 30% and 50% offshore exposure is attributed to a well-diversified and possibly tactical portfolio construction. Offshore allocation should be part of a holistic, diversified and long-term financial plan. I usually discourage considerable offshore exposure because you do not want to hedge your retirement savings against the currency you will ultimately retire in and live off. It is also dangerous to presume that the Rand will always depreciate to the Dollar or any other currency. What if it holds steady or continues to appreciate against the Dollar? The risk involved is just too high.

What are the benefits of investing offshore?

Even in these current volatile conditions, investing offshore allows you to benefit from a broader global universe. This means that you are not only limited to what the South African market offers but more opportunities to invest in long-term growth sectors, such as technology. Any of the top five listed companies in the world is greater than the combined value of all the companies listed on the Johannesburg Stock Exchange (JSE). Saying “past performance is not indicative of future performance” is accurate. It is, however, helpful to look at past performance figures to help you make a more informed decision. This graph reflects how the MSCI World Index as performed over the last five years, relative to the JSE. You will see that the growth of the MSCI outperforms the JSE by some margin.

Which routes could you go?

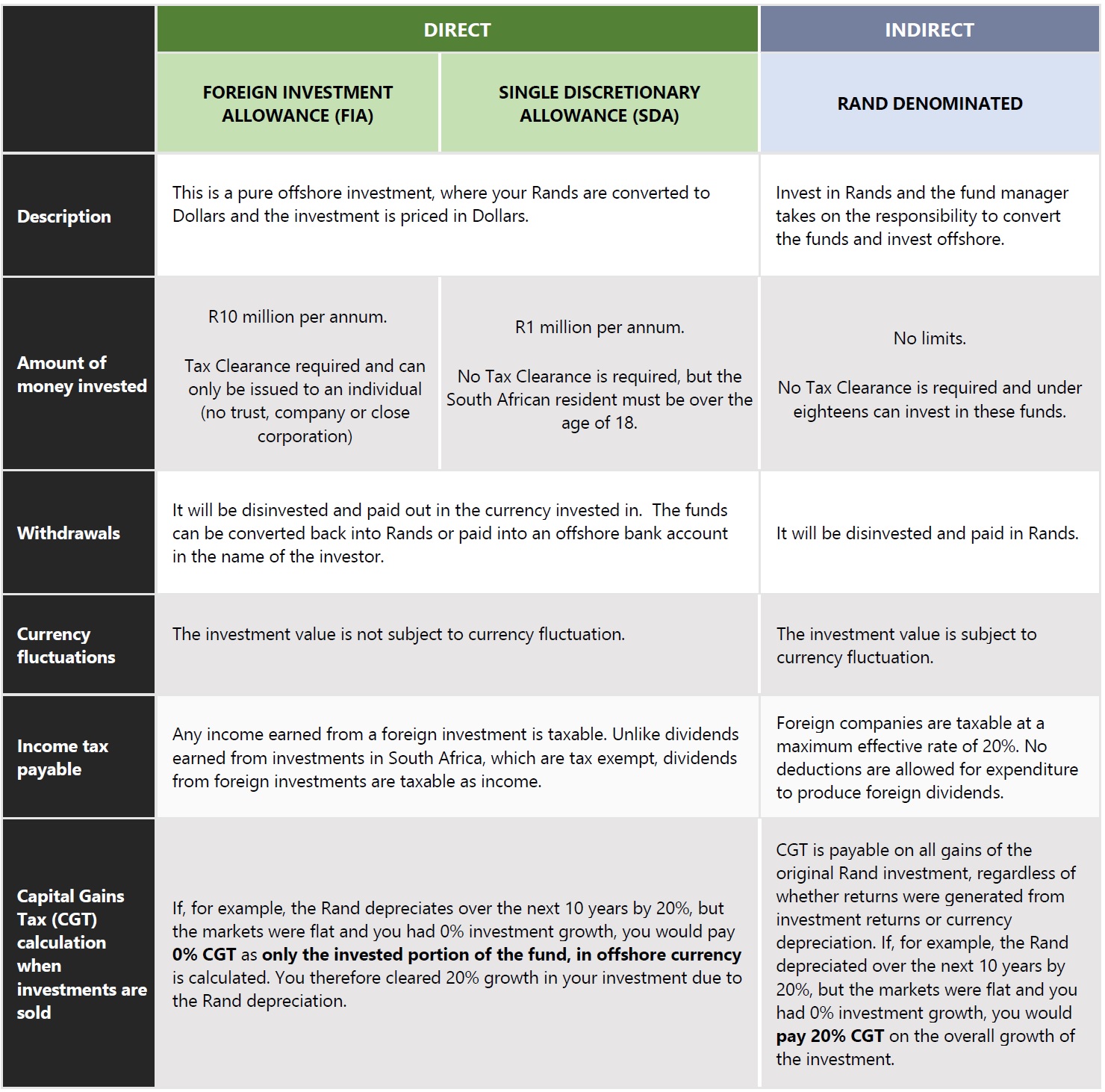

There are two ways of gaining offshore exposure. You can either go direct or indirect.

Depending on the route you follow, there are certain complexities involved with investing offshore. It is always useful consulting with an expert who can assist you in navigating the investment landscape. PPS Wealth Managers are here to help ensure your portfolio is structured in a tax-efficient manner and the funds’ allocation is optimal to meet your long-term goals.

By Karlin Pather, PPS Wealth Manager

Kindly note that this article does not constitute financial advice; the information provided is purely informational. In terms of the Financial Advisory and Intermediary Services Act, an FSP should not provide advice to investors without an appropriate risk analysis and thorough examination of a client’s particular financial situation. The information, opinions and any communication from PPS Insurance, whether written, oral or implied are expressed in good faith and not intended as investment advice, neither do they constitute an offer or solicitation in any manner. PPS is a licensed Insurer and authorised FSP (FSP 1044).

https://www.pps.co.za/newsletters/what-pps-has-say-offshore-exposure-retirement-planning-it-everyone