Intro Title

WHAT IS CRITICAL ILLNESS COVER & WHY DO YOU NEED IT?

Critical Illness Cover is designed to ease the financial pressures of suffering from a severe illness, by paying a lump-sum amount if you are diagnosed with, and survive, a life altering illness such as cancer, heart attack, stroke, multiple sclerosis or Parkinson’s disease.

Financial stress can contribute to or exacerbate your diagnosis.

Critical Illness Cover helps to alleviate the financial stress, so that you can focus on managing your illness. At a time like this, we want you to focus all your energies on getting better.

Product Featured Title

Benefits and level premium options

WHATEVER STAGE IT IS, CANCER IS STILL CANCER

PPS Critical Illness Cover now includes: Low severity conditions, including early cancer, like Group 1 cancer of the prostate and micro-carcinoma of the thyroid and bladder which were previously excluded. Flexibility for members to choose to access funds for medical events that are unlikely to necessitate significant lifestyle adjustments. With reinstatement of cover, receive up to 200% of your cover amount. After you claim for a cancer or cardiovascular condition, you may qualify for a second 100% payment.

LEVEL PREMIUMS OPTIONS

We’ve included a broader range of benefit options available for an additional fee, including level premiums for members who prefer to pay the same premium for the duration of the policy, and we now offer both age-rated and level premiums giving members choice and flexibility.

Product Feat 2 Title

Critical Illness Cover product features

At PPS, we have improved and enhanced our Critical Illness Cover offering to keep pace with the continuously evolving world of medicine and ensure that we provide our members with relevant and effective cover. We have enhanced our base definitions for both existing and new members, without a change in premiums or rates. We believe in giving our members choice and flexibility, and have three options that members may select from, depending on the type and level of cover required. The benefit pays out a lump-sum amount depending on the severity of the condition and benefit option, payment ranges from 5% – 100%.

Benefits Title

All options include great key benefits that automatically apply from day one

All options include great key benefits that automatically apply from day one

Child critical illness benefits

Automatically covers the member’s children from birth to 21 years for all conditions covered under the product and pays 10%, up to R250 000, per related condition.

Reinstatement of cover benefit for cancer and cardiovascular conditions

This means that these two claims categories could get up to 200% payment.

Optional benefits

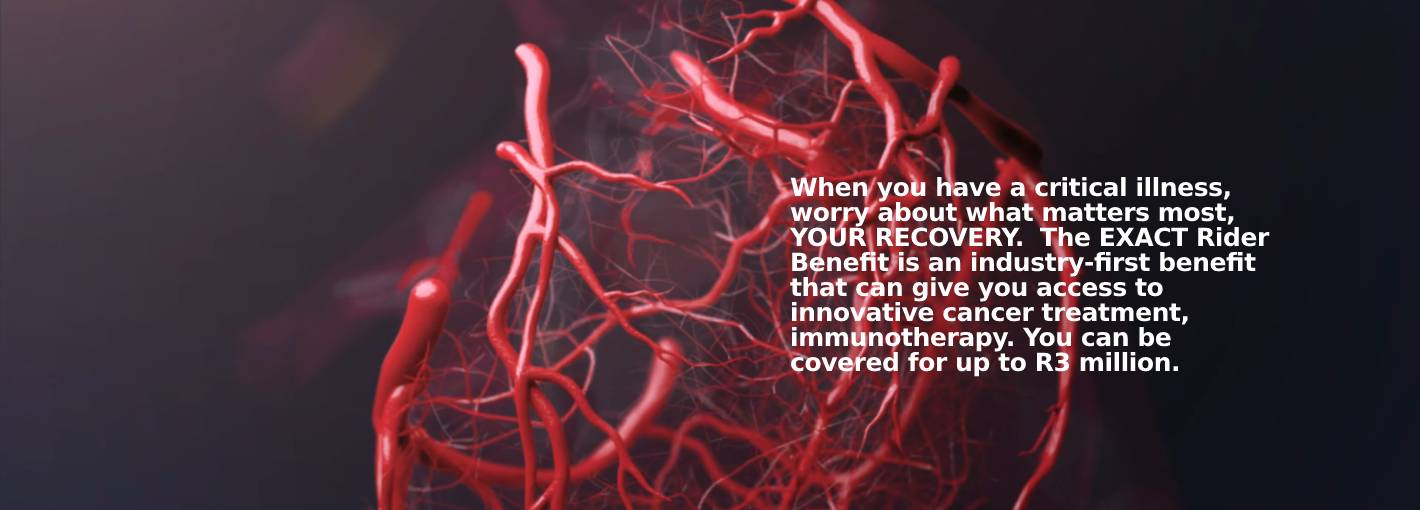

EXACT rider benefit

In the event that a PPS member suffers from cancer and receives a claim payout from the main Critical Illness Cover, the EXACT Rider benefit will pay an additional lump sum if the cancer proves to be susceptible to targeted therapy treatment (as indicated by specific laboratory tests).

EXPANDER rider benefit

Should you detect a Critical Illness early in its development, PPS now offers real value with a maximum payment of up to R250 000 under all Critical Illness categories, depending on the severity of the condition.

CI 100% Cover

Covers most listed conditions at 100% regardless of severity level.

CORE 100% Cover

Covers the four most common conditions at 100%, regardless of the severity level. Cancer, heart attack, stroke and coronary artery bypass graft. All other listed conditions are paid on a tiered basis, depending on the severity of the condition

CatchAll benefit

Adds a benefit category covering any severe condition not covered under the listed categories. The benefit is payable at 25%, 50% or 100%, depending on the member's inability to do activities of daily living.

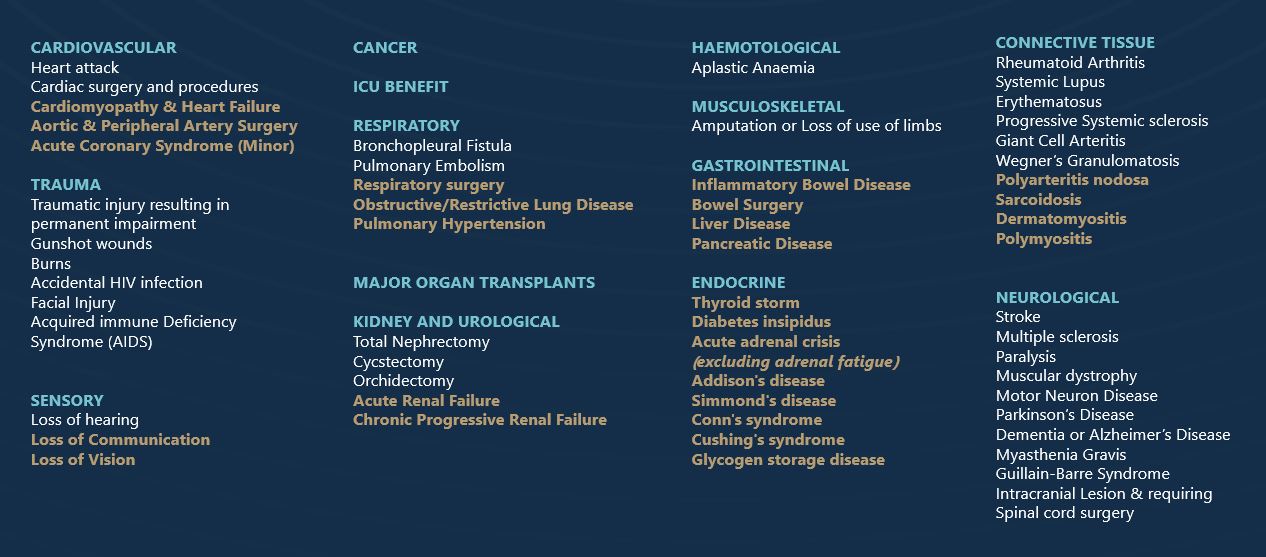

Conditions covered