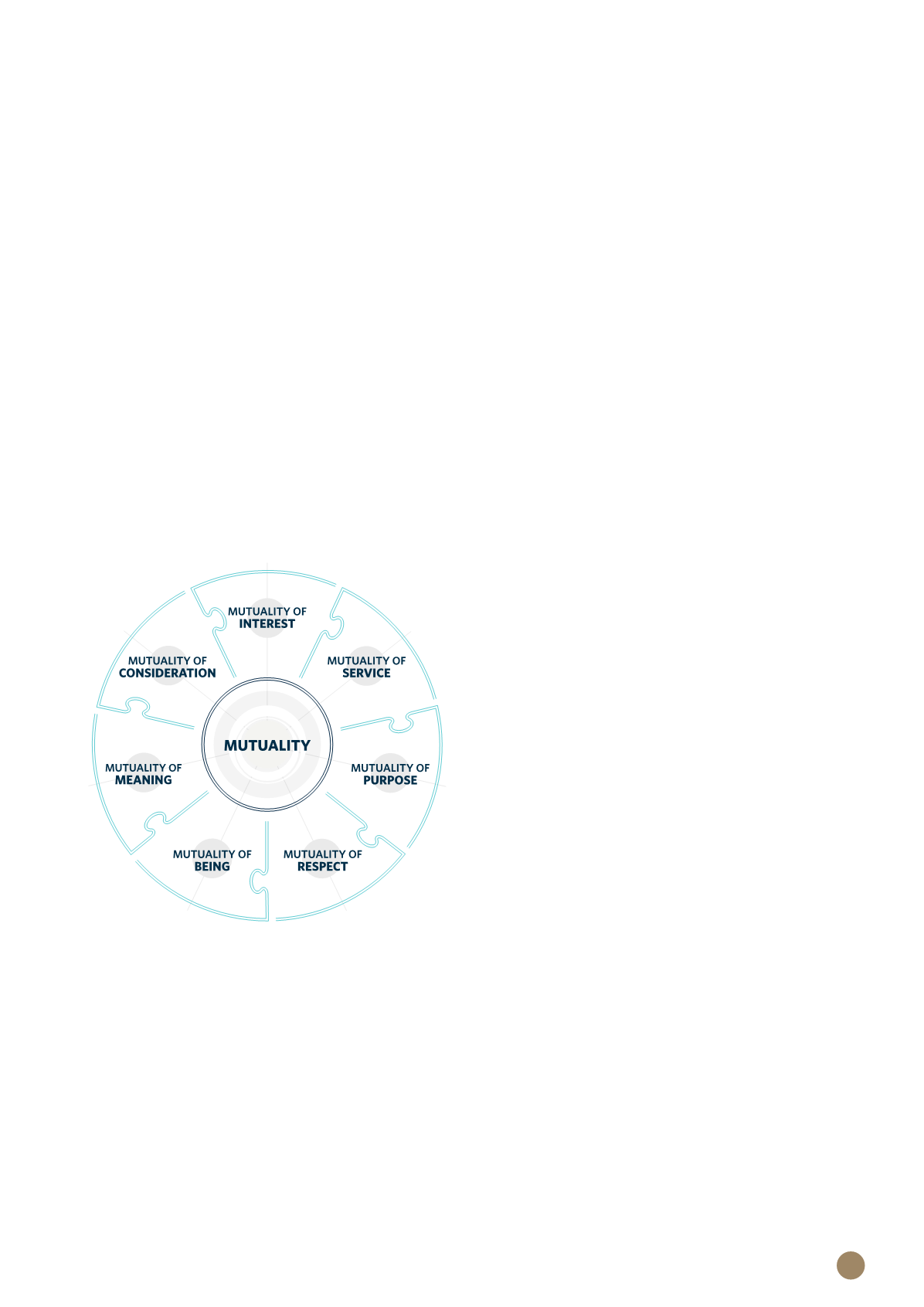

THE MUTUAL ETHOS

Unlike most financial services providers in South Africa,

PPS is not listed on any stock exchange and has no

external shareholders. Instead, PPS operates under

the ethos of mutuality and all profits and investment

returns generated are allocated to PPS members with

qualifying products on an annual basis through their

PPS Profit-Share Accounts.

Mutuality is central to our success. Profits and

investment returns are reinvested with a long-term

mindset on members’ behalf. These funds accumulate in

our members’ PPS Profit-Share Accounts (irrespective

of their claims) and vest free of tax at retirement, or

upon death. This benefit has no rival in South Africa.

FOCUS ON THE GRADUATE

PROFESSIONAL MARKET

PPS stands apart from all other financial services

providers, distinguished by:

• Only accepting qualifying graduate professionals

who meet our criteria

• A business model based on mutuality – our members

are the de facto shareholders

As such, member interests inform all our decisions and

actions. PPS has operated according to this model since

our founding over 77 years ago – and will continue

doing so.

LONG-TERM MINDSET

PPS is not focused on delivering short-term returns to

members. PPS is focused on creating and sustaining

long-term growth and wealth, recognising that there is

an alignment of the interests of policyholders – unique

to the insurance industry in South Africa.

The mutual structure allows our management team and

the Board to adopt a long-term approach to running the

business, deploying sustainable long-term strategies,

which make the most efficient use of capital, and benefit

all the generations of professionals we serve.

MEMBERS’ RETURNS

Once members retire from their PPS Insurance

products, the profits they have accumulated over

the course of their membership through their PPS

Profit-Share Accounts will vest. The profits will become

accessible via the Vested PPS Profit-Share Account,

irrespective of whether or not they have claimed,

and

vest at retirement from age 60. This is a unique feature

in the South African insurance sector. The Vested

PPS Profit-Share Account allows members to keep

their PPS Profit-Share Account assets invested for

longer to generate further returns and supplement

their retirement savings.

GOVERNANCE

PPS Insurance is a registered insurer and is subject to

the same governance requirements as a listed insurer.

A unique additional layer of governance is the fact

that our members and professional associations are

represented at the PPS Holdings Trust Board level – the

ultimate control structure of the Group. There is no other

insurance company in South Africa where policyholders

are specifically represented at Board level.

15