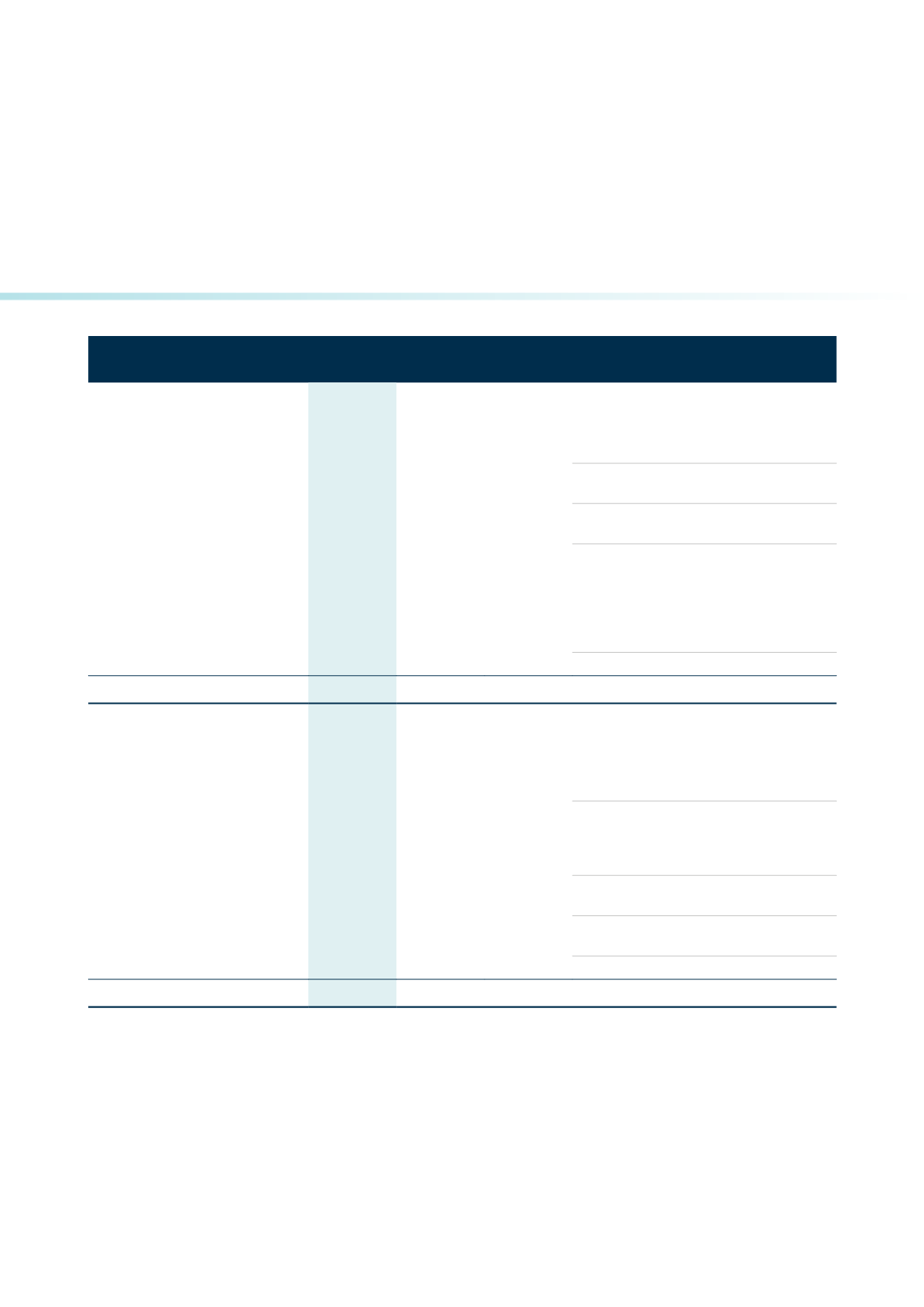

2017

2016

Change

R’000

R’000

R’000 DESCRIPTION OF INDIVIDUAL ITEMS

ASSETS

Property and equipment

593 445

546 196

47 249 Fixed assets. These include PPS' head office

premises, furniture, equipment, computers

and vehicles.

Investment property

381 869

356 469

25 400 Properties which are held for the purpose of

rental income and capital appreciation.

Intangible asset

89 941

73 187

16 754 PPS Internally developed insurance

software.

Other non-current assets

41 395 493

37 149 710 4 245 783 Assets backing insurance liabilities. These

mainly include investments in equities

and bonds, which assets are managed

by investment managers who act in

accordance with investment mandates set

by the board of directors of PPS Insurance.

Current assets

3 530 857

2 382 905 1 147 952 Primarily cash resources of PPS Group.

Total assets

45 991 605 40 508 467 5 483 138

EQUITY AND LIABILITIES

Total equity

449 414

400 086

49 328 Statutory capital requirement of the

insurance entities, revaluation reserve of

owner-occupied properties, certain reserves

of subsidiaries, and minority interest.

Insurance policy liabilities

31 417 920

28 216 448 3 201 472 Policyholders' funds consisting of (a)

capital held to settle future insurance

claims, and (b) PPS Profit-Share Accounts

of members.

Investment contract liabilities

1 876 916

1 464 986

411 930 Funds of members invested in PPS living

annuities and endowment products.

Liabilities to unit trust holders

10 709 000

9 088 757 1 620 243 Value of outsiders' investments in unit

trusts in which PPS owns a majority stake.

Other liabilities

1 538 355

1 338 190 200 165 Primarily short-term liabilities.

Total equity and liabilities

45 991 605 40 508 467 5 483 138

PPS GROUP CONSOLIDATED

STATEMENT OF FINANCIAL

POSITION

as at

31 December 2017

25