HOW PPS ADDRESSES

PRINCIPAL RISKS AND

UNCERTAINTIES

RISKS

PPS exists to take care of the financial interests of its members, by providing advice, products and services for the optimal creation,

protection and management of the wealth of its members throughout their lives and their legacies. The principles of mutuality as

well as the objectives to operate ethically, responsibly and within the confines of applicable legislation are key considerations which

determine our risk appetite.

PPS is cognisant of the key business risks, as outlined below, which may have a material impact on our operations. Strategies are in

place to mitigate these risks wherever possible.

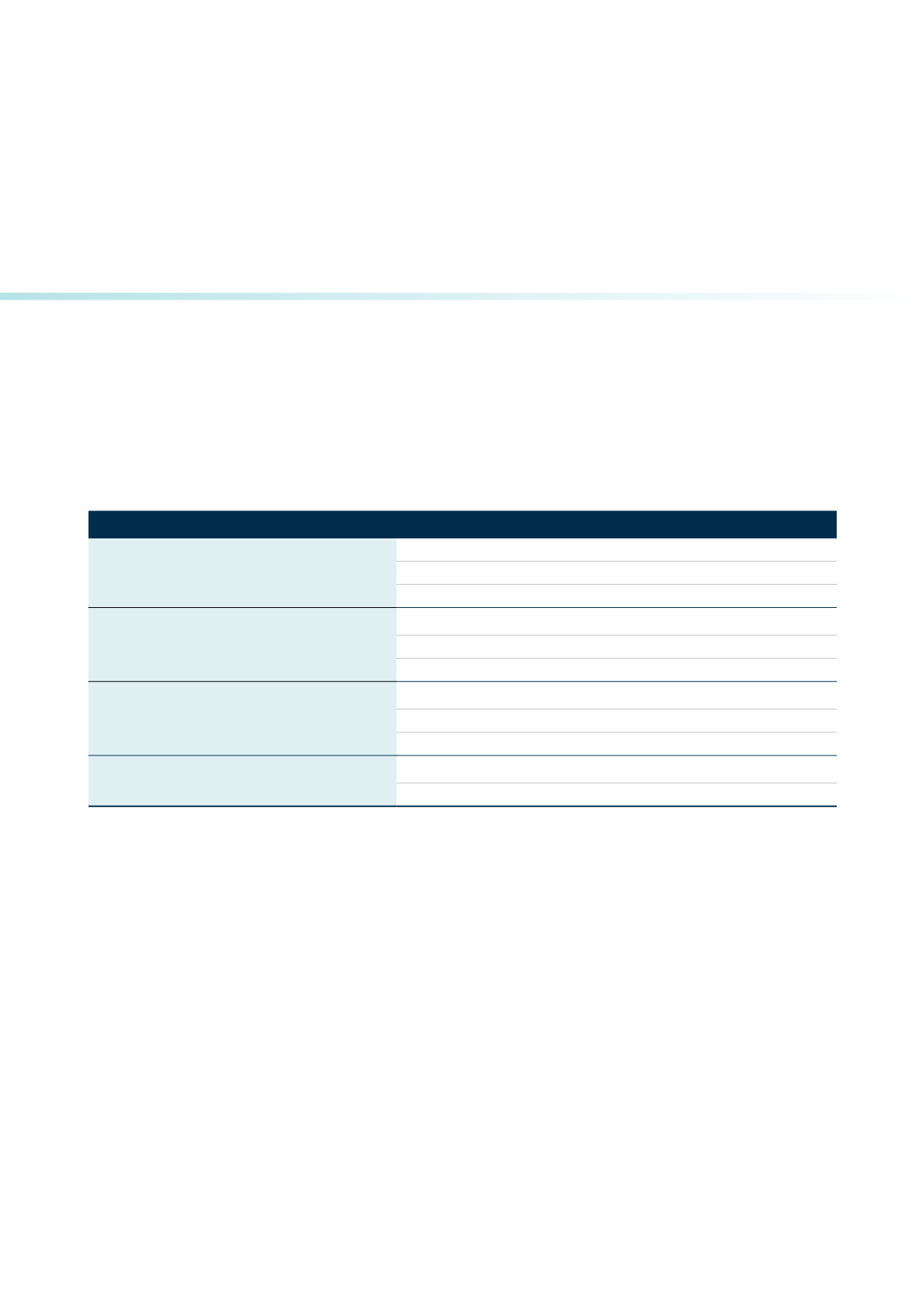

Risk table:

RISK

MANAGEMENT ACTIONS

1.Slow economic growth

• Grow our brand awareness

• Continuously enhance group product and service offerings

• Grow distribution reach

2.Membership growth

• Build member community

• Digital engagement

• Profit-Share Account benefits

3. Market risk and volatile investment return

• Long-term investment horizon

• Balanced portfolios with international exposure

• Multiple asset managers

4. Sustainability

• Strategic opportunities

• Exploit efficiencies

23