PPS ADVISORY SERVICES

PPS Advisory Services is our internal agency channel

which, like our external independent advisers, strives

to improve our members’ quality of life by providing

holistic financial advice. The advice process has

been customised to meet the needs of graduate

professionals. Many studies have shown the big

correlation between financial independence and

financial advice interventions.

What we do

We provide recommendations, guidance and proposals

to our members on a range of financial planning

solutions and offer expert advice on the entire suite

of PPS products, designed exclusively for the graduate

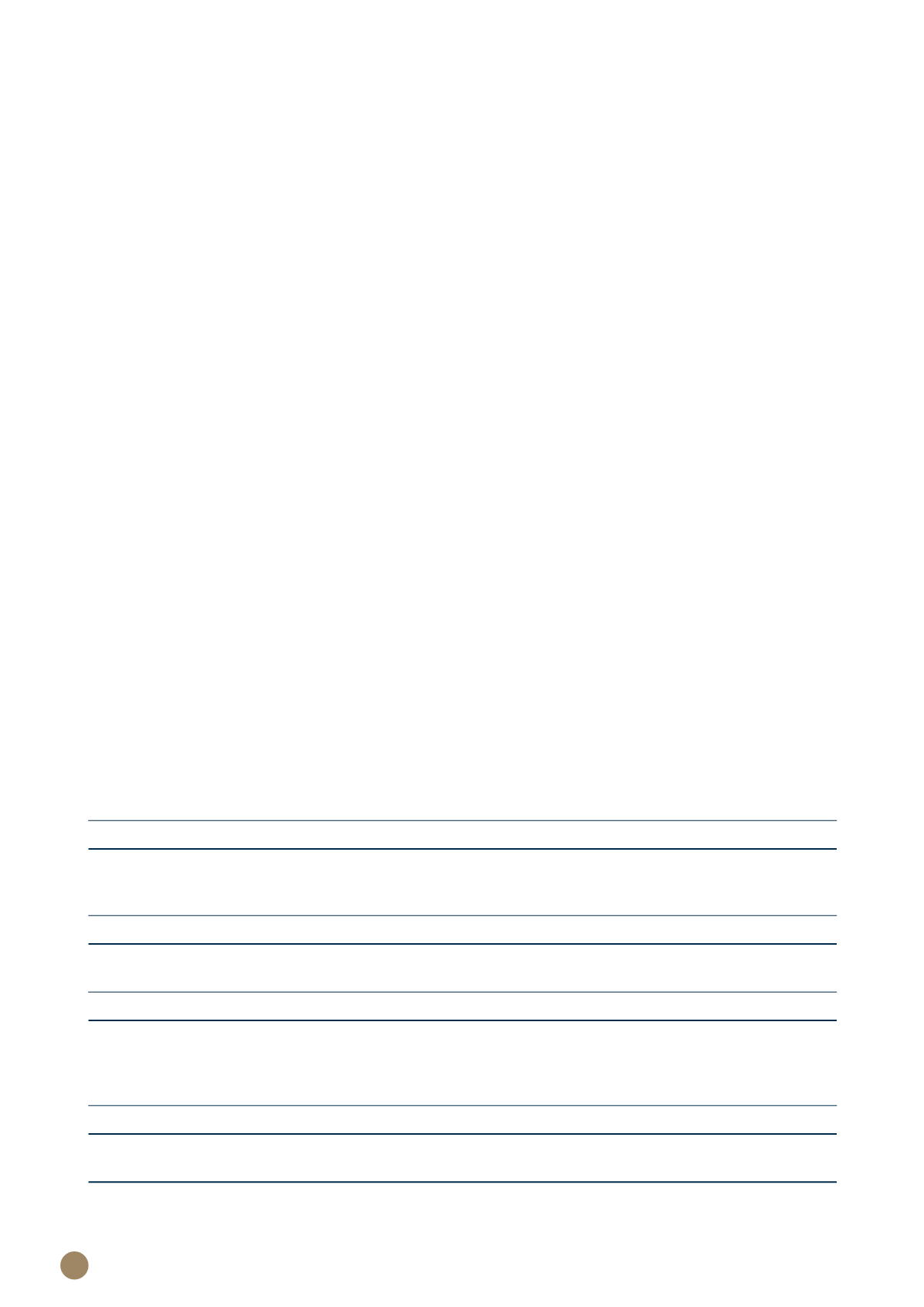

professional. The table below includes some of the

advisory services on offer.

Performance

An internal re-organisation yielded an enhanced

structure, where Financial Advisory replaced the

former separate Life and Investment Advisory

businesses. The new structure allows our advisers,

carefully selected for the professional market

segment, to provide a range of financial planning

solutions that include the entire suite of PPS products.

The re-organisation inevitably required some internal

focus, leading to negative growth in the channel during

the first half of 2018, but there was again positive

year-on-year growth in the second half.

The PPS Lifestyle Financial Planning team was also

repositioned in 2018 as Specialist Support Services

(S

3

), offering specialist and holistic support to the

internal Financial Advisory Services channel, the

external independent advisory channel, and directly

to members. This team is product agnostic, enabling a

greater partnership and support base for our accredited

PPS advisers, both internal and external of the

organisation, for the ultimate benefit of our members.

Risks, challenges and opportunities

Financial regulations in many countries are becoming

increasingly onerous – and South Africa is no different.

The industry has experienced numerous legislative and

technological changes, but has generally been able to

respond by developing new advice and compliance

processes through incoming technologies, such as

the deployment of a new internal adviser platform at

PPS in 2018.

Prospects

For 2019, we have prioritised growth by expanding and

entrenching our footprint in major cities, building our

presence in many regions. Growth is also stimulated

by deepening relationships with stakeholders such as

professional associations and academic institutions.

Financial planning

• Our holistic planning process typically considers various lifestyle and financial areas including income, health,

possessions, family, interests and hobbies, career and retirement.

• We partner with members to tailor their specific financial journeys to their unique goals and needs

Risk product advice

• Our advice process adopts a risk management approach to financial advice

• It considers unique member needs and prioritises product solutions accordingly

Investment guidance

• The advice process considers goal orientation and risk appetite to yield product solutions and fund selection

with appropriate portfolio management

• Our processes and solutions support advisers, both internal and external, to in turn support members with

appropriate investment guidance

Retirement and estate planning

• The advice process considers estate liquidity

• The solutions enable intergenerational wealth planning - securing the future and leaving a legacy

GROUP OVERVIEW

(continued)

PPS

INTEGRATED REPORT 2018

32