Risks, challenges and opportunities

Diminishing returns from systematically volatile markets

are PPSI’s biggest challenge at this time. While PPSI is

structurally well-equipped to deal with volatile markets,

prolonged negative returns will understandably dampen

investor confidence. Our challenge is to continuously

update members and advisers on market implications.

Another issue is the ageing adviser community, which

requires robust recruitment and education of new

advisory talent to keep the savings and investment

industry stable.

Changing regulation has opened the door to a more

integrated and productive working relationship with

the adviser community.

Prospects

Looking forward to 2019, we will further build

efficiencies on the new administration platform.

We are also bolstering awareness of the PPS Vested

Profit-Share Account, as it is becoming increasingly

popular for members using their vested values to

augment their retirement income. Many members are

finding it easier to maintain post-retirement healthcare

costs and short-term insurance premiums through their

PPS Vested Profit-Share Account.

PPS INVESTMENTS

KEY INDICATORS

2018

FIVE-YEAR REVIEW

PPS Investments offers

investment, retirement and

savings products to PPS

members.

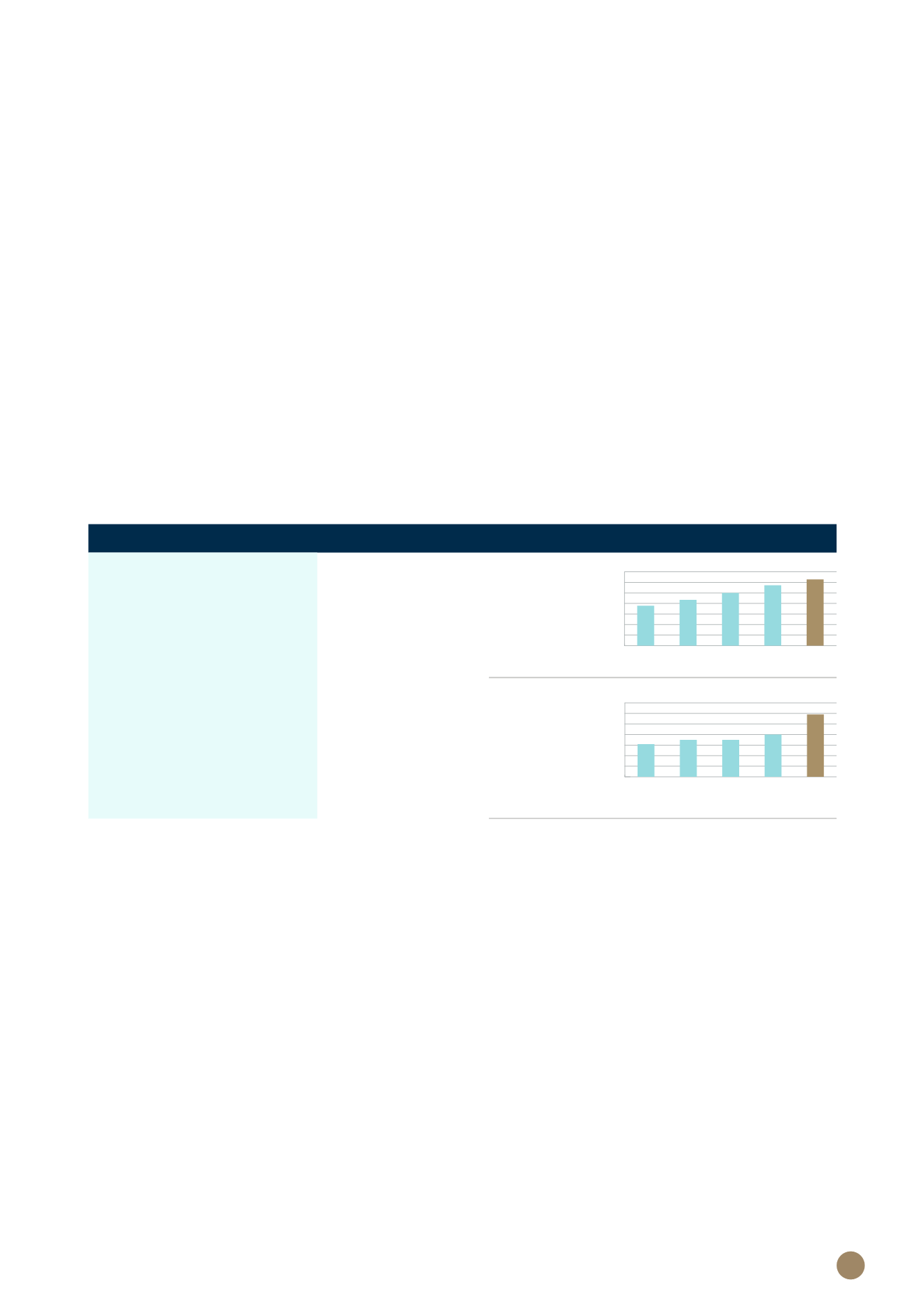

Total assets

under administration

R31.4 billion

New business: flows R5.9 billion

2014

2018

2017

2016

2015

0

5

10

15

20

25

30

35

R’bn

2014

2018

2017

2016

2015

0

1

2

3

4

5

6

7

R’bn

29