183

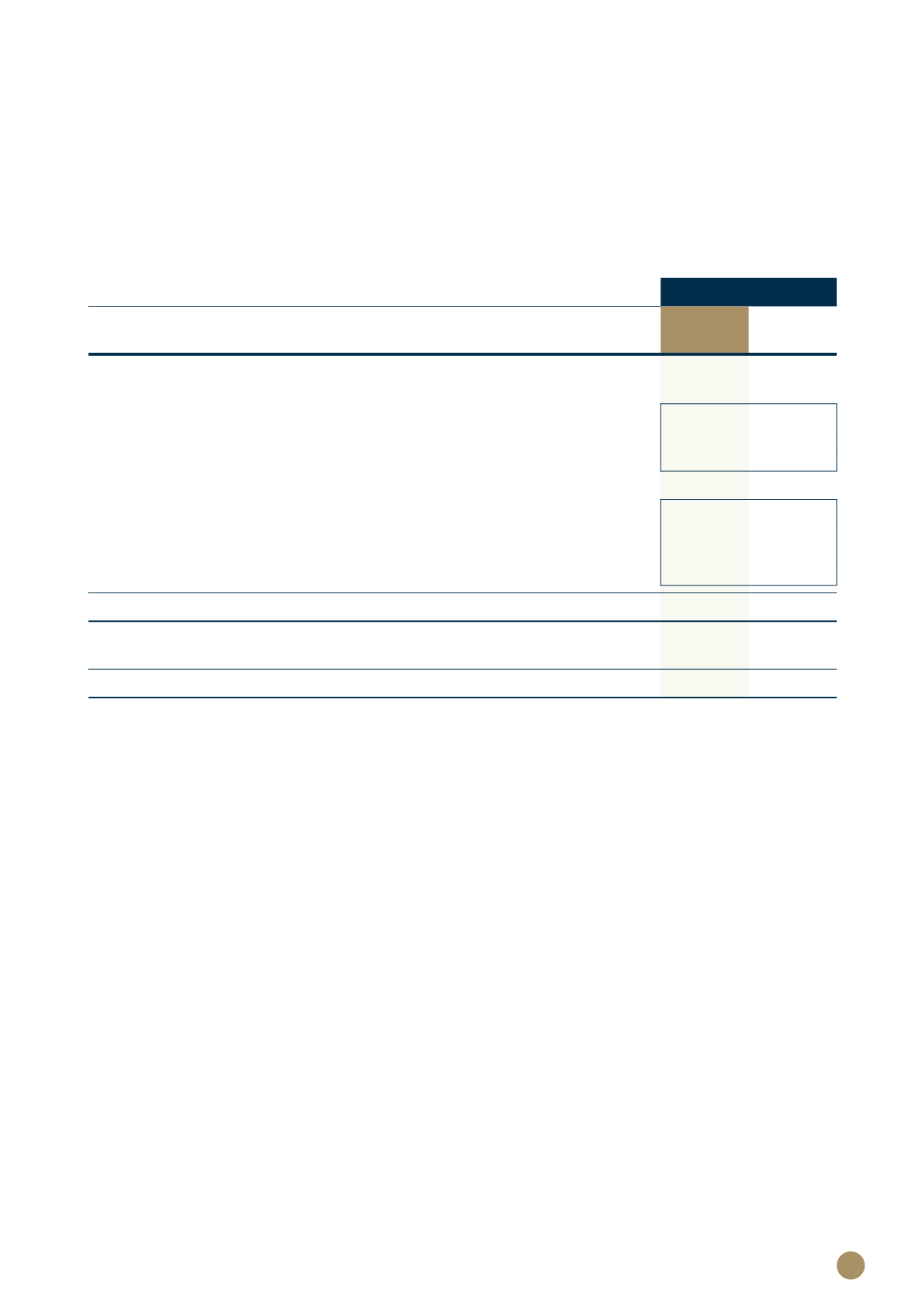

STATEMENT OF CASH FLOWS

for the year ended 31 December 2018

Trust

2018

2017

R’000

R’000

Cash flows from operating activities

Cash generated from operations

4 073

822

– Surplus/(Deficit) before tax

8 226

(2 673)

– Changes in Receivables

(3 791)

3 355

– Changes in Payables

(362)

140

Tax paid

(1 583)

(675)

– Tax receivable at beginning of year

1 271

(596)

– Current tax as per Statement of Profit or Loss, Other Comprehensive Income and

Equity

(2 801)

–

– Tax receivable at end of year

(53)

1 271

Net cash from operating activities

2 490

147

Net increase in cash and bank

2 490

147

Cash and bank at beginning of year

1 597

1 450

Cash and bank at end of year

4 087

1 597

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

1. EQUITY

PERMANENT CAPITAL

An amount of R100 was contributed to the trust fund of the beneficiaries on formation of The Professional

Provident Society Holdings Trust during 2011.

ACCUMULATED FUNDS

The Accumulated funds balance represents the cumulative profits and losses of the trust since inception.

2. TOTAL INCOME

Income is recognised in line with IFRS 15 "Revenue from contracts with customers". There are no material

changes to revenue recognition of administration fees income which is recognised under IFRS 15.

Total income comprises of administration fees received from PPS Insurance Company Limited and income

from the PPS Members Forum which comprises sponsorship and entrance fees.

Income from the PPS members forum was recognised after the conclusion of the event.