PPS

INTEGRATED REPORT 2018

120

NOTES TO THE

CONSOLIDATED

FINANCIAL STATEMENTS

(continued)

for the year ended 31 December 2018

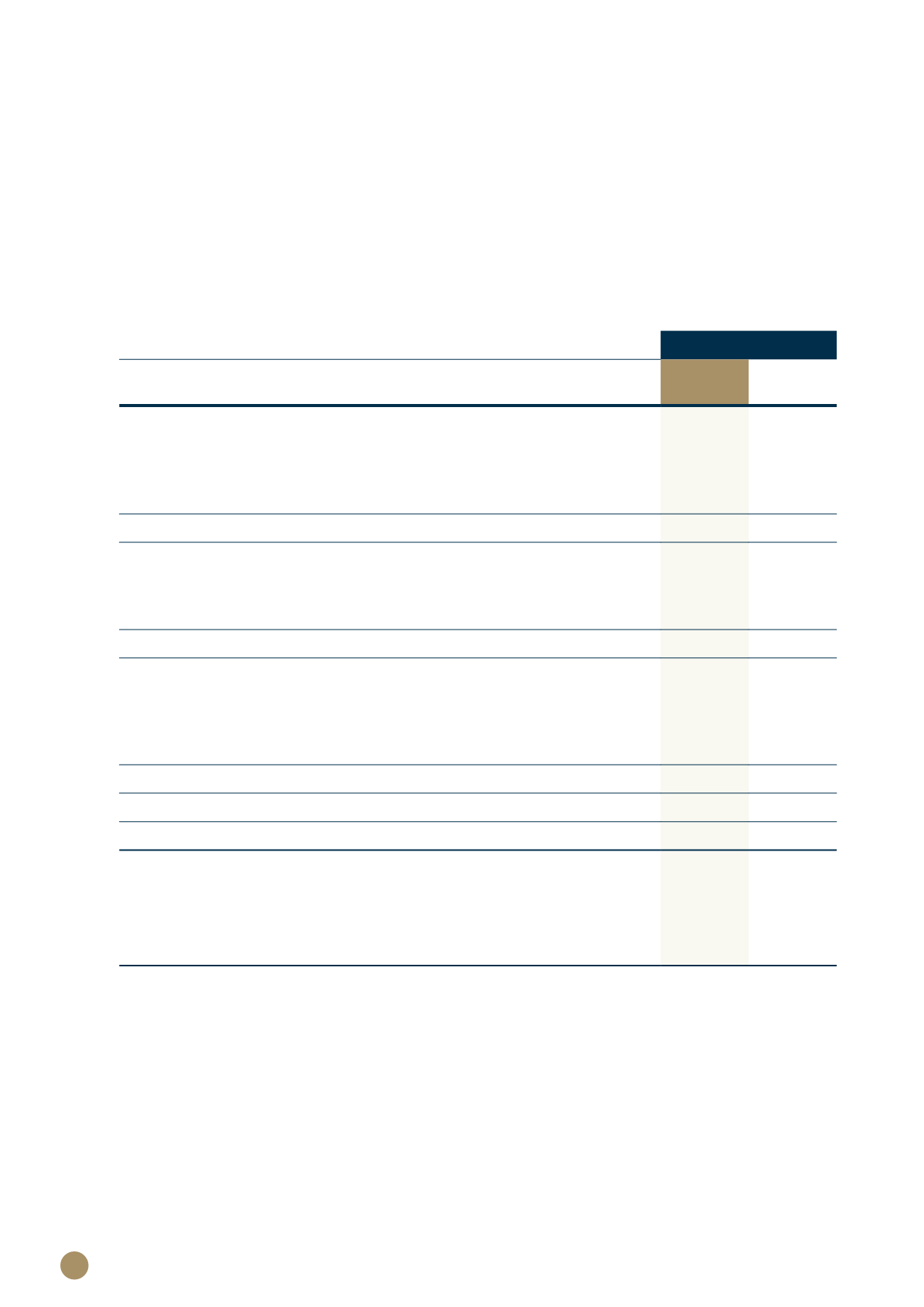

5. FINANCIAL ASSETS – INVESTMENTS AT FAIR VALUE THROUGH PROFIT

OR LOSS

Group

2018

2017

R'000

R'000

Analysis of financial assets held at fair value through profit or loss

Level 1 fair value financial assets

Equity securities:

– local listed

13 683 791

14 711 830

– international listed

104 144

96 834

13 787 935

14 808 664

Level 2 fair value financial assets

Debt securities – fixed interest rate:

– government bonds and local listed

8 974 934

7 094 137

– international listed

381 367

328 108

9 356 301

7 422 245

Unit trusts and pooled funds:

– local pooled funds and unit trusts

13 805 341

12 620 444

– international equity unit trusts

3 532 610

3 595 646

– international fixed interest unit trusts

38 608

145 800

– international balanced unit trusts

2 467 713

2 595 847

19 844 272

18 957 737

Total level 2 fair value financial assets

29 200 573

26 379 982

Total financial assets at fair value through profit or loss

42 988 508

41 188 646

The investment in local pooled funds and unit trusts comprises mainly of:

Debt securities

6 356 534

5 697 315

Cash and cash equivalents

189 286

199 166

Equities

5 454 349

5 313 187

International

1 805 172

1 410 776

International investments denominated in foreign currencies were translated to Rands at the closing exchange

rates at 31 December 2018 of:

$1 = R14.35 (2017: $1 = R12.38)

N$1 = R1.00 (2017: N$1 = R1.00)

At 31 December 2018, investments classified as Level 2 comprise approximately 67.9% (2017: 64.0%) of financial

assets measured at fair value. Debt securities are classified as Level 2 as directly observable market inputs

other than level 1 inputs have been used to value these bonds. The observable inputs used to determine the

fair value of unit trusts and pooled funds classified as Level 2 are the unit prices published by the unit trust

fund managers.

At 31 December 2018, no financial assets are classified as Level 3 (2017: nil).