117

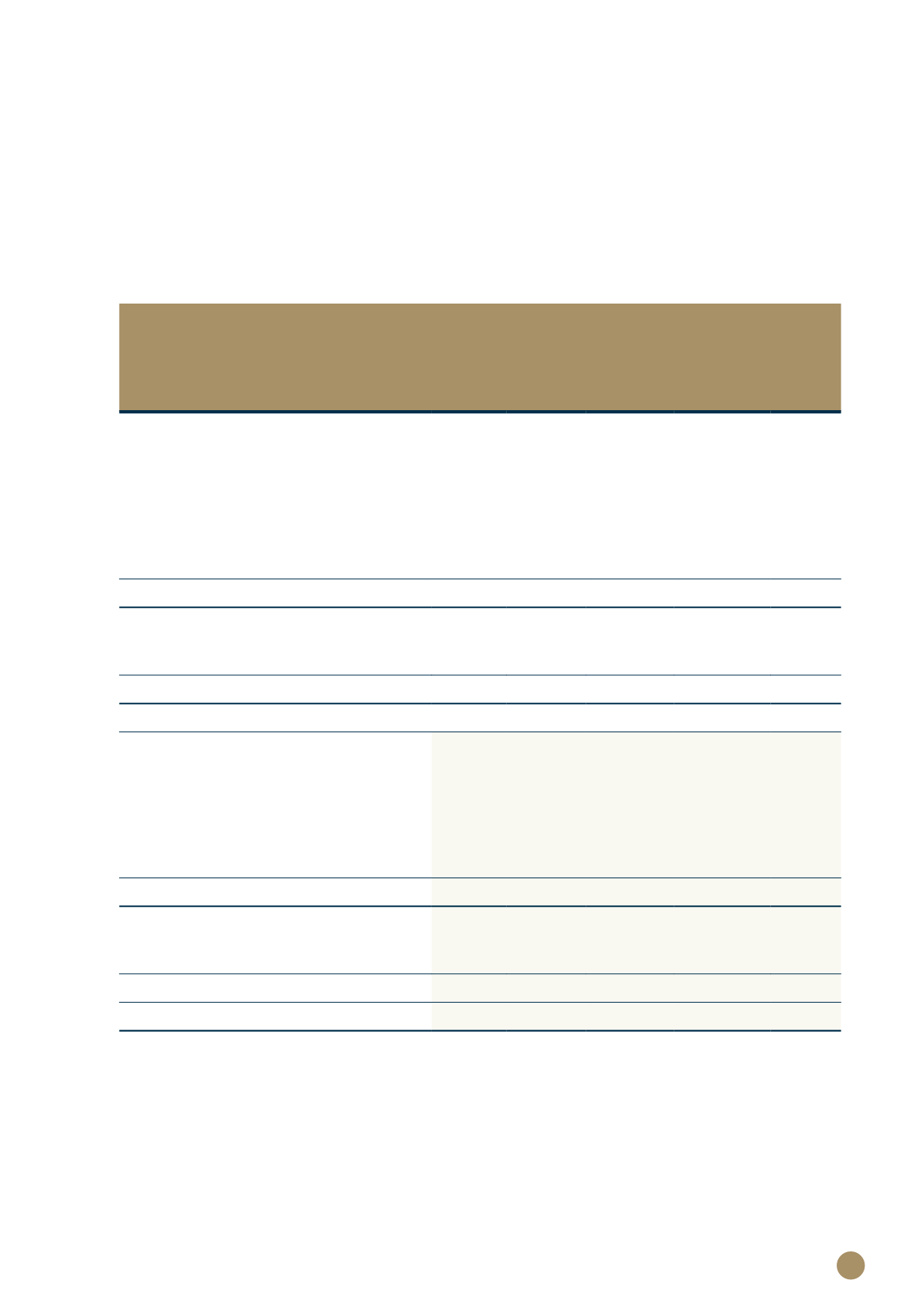

2. PROPERTY AND EQUIPMENT

Owner-

Vehicles,

office Leasehold

occupied Computer furniture &

improve-

property hardware equipment

ments Total

R'000 R'000 R'000

R'000 R'000

Year ended 31 December 2017

Opening net book amount

428 022 49 794

48 012

20 368 546 196

Revaluation surplus

19 259

–

–

– 19 259

Depreciation relating to revaluation

(503)

–

–

–

(503)

Additions

17 498 23 669

29 118

947 71 232

Disposals: Cost

– (43 552)

(17 862)

– (61 414)

Disposals: Accumulated Depreciation

–

43 542

17 685

– 61 227

Depreciation charge

(854) (24 410)

(13 885)

(3 403) (42 552)

Closing net book amount

463 422 49 043

63 068

17 912 593 445

At 31 December 2017

Cost or valuation

478 026 129 778

124 630

28 607 761 041

Accumulated depreciation

(14 604) (80 735)

(61 562)

(10 695) (167 596)

Net book amount

463 422 49 043

63 068

17 912 593 445

Non-current

463 422 49 043

63 068

17 912 593 445

Year ended 31 December 2018

Opening net book amount

463 422 49 043 63 068

17 912 593 445

Additions

14 366 37 262 34 346

760 86 734

Disposals: Cost

– (38 055) (26 669)

– (64 724)

Disposals: Accumulated Depreciation

–

38 055 26 203

– 64 258

Depreciation charge

(860) (26 804)

(13 241)

(3 516) (44 421)

Revaluation surplus

5 038

–

–

– 5 038

Closing net book amount

481 966 59 501

83 707

15 156 640 330

At 31 December 2018

Cost or valuation

481 966 128 985 132 307

29 367 772 625

Accumulated depreciation

– (69 484) (48 600)

(14 211) (132 295)

Net book amount

481 966 59 501

83 707

15 156 640 330

Non-current

481 966 59 501

83 707

15 156 640 330

The land and buildings revaluation represents the capital appreciation on the owner-occupied properties.

As the properties are held to back insurance policy liabilities, with discretionary participation features, the

movement in insurance policy liabilities as a result of the revaluation is recognised directly in equity.