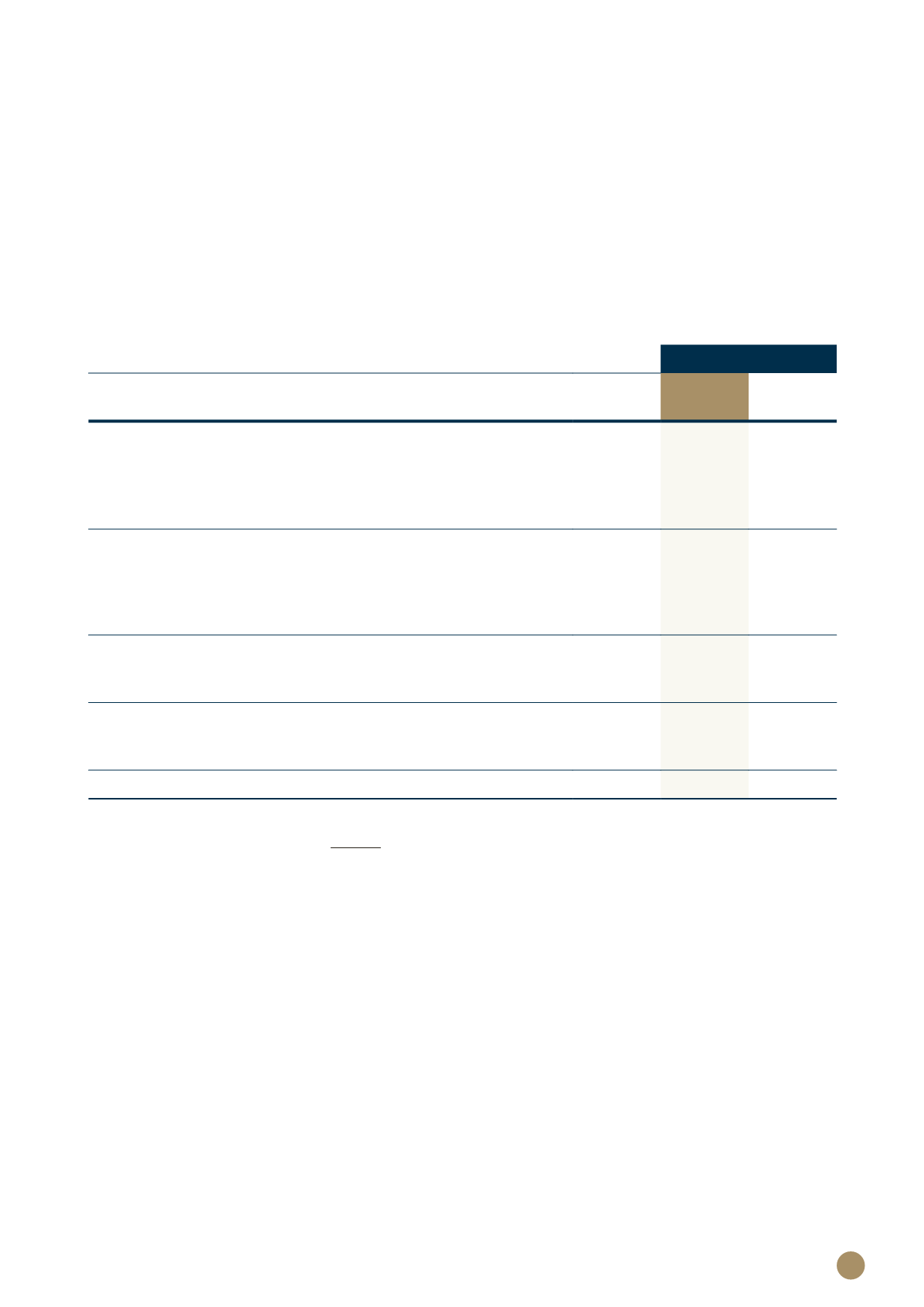

97

Group

2018

2017

Note

R'000

R'000

Net insurance premium revenue

21

4 163 102

3 858 384

Other income

22

418 219

437 165

Investment income

23

2 097 695

1 823 561

(Losses)/profits on financial assets and investment property

24

(2 083 475)

2 770 571

Attributable to unit trust holders

15

(154 618)

(966 613)

4 440 923

7 923 068

Net insurance benefits and claims

25

2 931 878

2 699 959

Movement in fair value of policyholder liabilities under investment

contracts

14

(48 342)

140 060

Expenses

26

1 910 477

1 596 492

(Loss)/profit before movement in insurance policy liabilities

(353 090)

3 486 557

Movement in insurance policy liabilities

12

(333 723)

3 011 553

Tax (credit)/charge

28

(27 939)

465 379

Surplus after tax and policy movements

8 572

9 625

Other comprehensive income:

Revaluation of owner-occupied property net of deferred tax

4 648

18 608

Total comprehensive income for the year

13 220

28 233

The mutual nature of PPS should be noted. The allocation to policyholders – described above as ‘Movement

to insurance policy liabilities’ – is a portion of the annual allocation to members’ PPS Profit-Share Account in

their capacity as policyholders. The balance of R968.3 million is from the movements in the Actuarial Reserve

(Non-Discretionary Participation Features ('Non-DPF') liability). The surplus after tax is the result of operations

of the non-insurance subsidiaries and any increase required to maintain capital.

CONSOLIDATED

STATEMENT OF PROFIT

OR LOSS AND OTHER

COMPREHENSIVE INCOME

for the year ended 31 December 2018