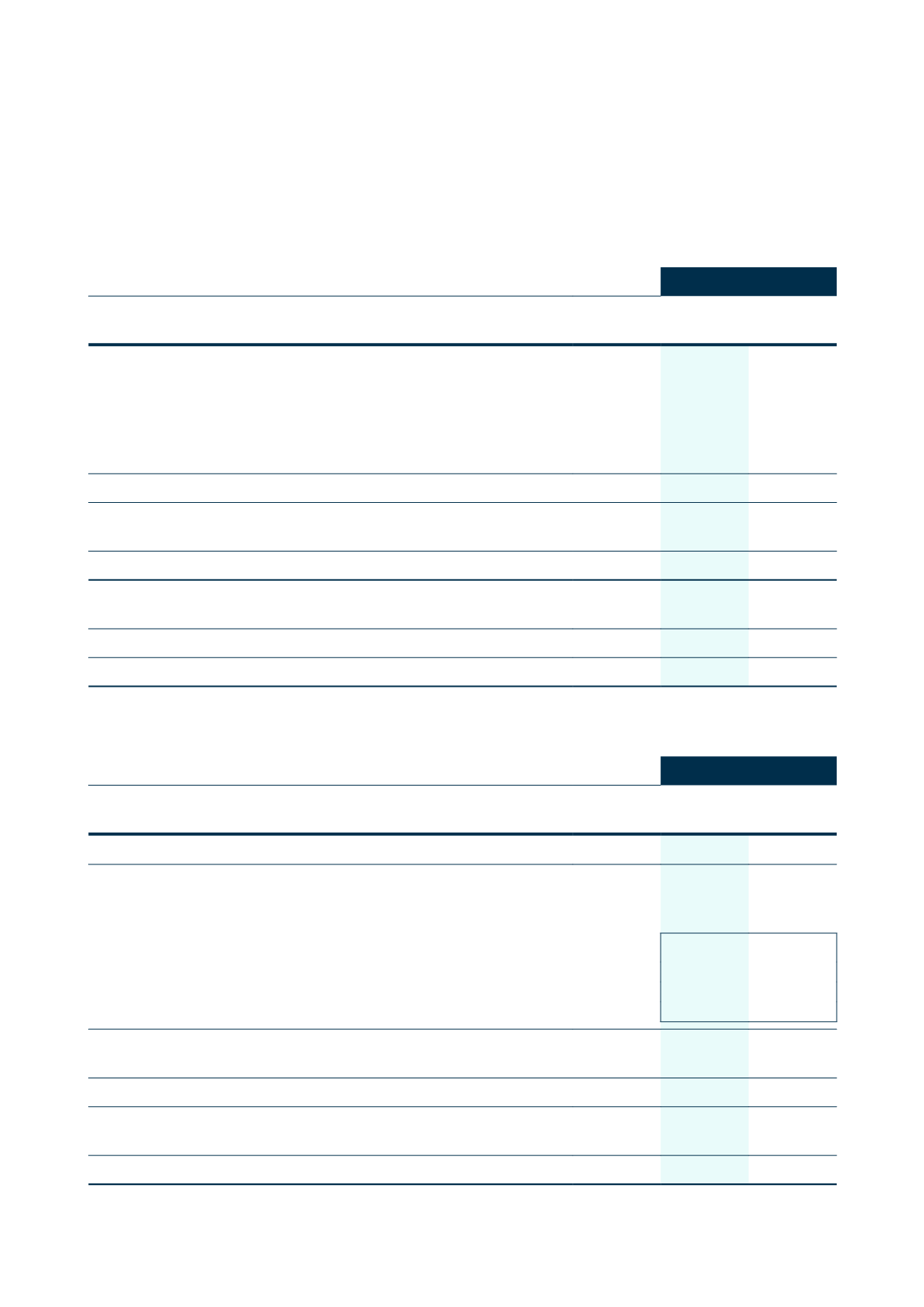

STATEMENT OF FINANCIAL POSITION

as at

31 December 2017

Trust

2017

2016

Note

R’000

R’000

ASSETS

Investment in 100% of the shares issued by subsidiary, PPS Insurance Company

Limited, at cost

10 000

10 000

Prepayments and Receivables from PPS Insurance Company Limited

961

4 316

Current income tax asset

1 271

596

Cash at bank

1 597

1 450

TOTAL ASSETS

13 829

16 362

EQUITY AND LIABILITIES

Accumulated funds

1

13 147

15 820

TOTAL EQUITY

13 147

15 820

LIABILITIES

Accruals and Value Added Tax payable

682

542

TOTAL LIABILITIES

682

542

TOTAL EQUITY AND LIABILITIES

13 829

16 362

ANNUAL FINANCIAL STATEMENTS

PPS HOLDINGS TRUST

STATEMENT OF PROFIT OR LOSS, OTHER COMPREHENSIVE INCOME AND EQUITY

for the year ended

31 December 2017

Trust

2017

2016

Note

R’000

R’000

Administration fees from PPS Insurance Company Limited

11 388

10 673

Total income

11 388

10 673

Total expenses

14 061

7 282

Trustees fees

3 951

3 725

Professional fees

544

426

Marketing expenses

6 511

–

Administration fees

3 055

3 131

(Deficit) / Surplus before tax

(2 673)

3 391

Tax

2

–

1 357

(Deficit) / Surplus after tax

(2 673)

2 034

Total comprehensive (loss) / income for the year

(2 673)

2 034

Accumulated funds at the beginning of the year

15 820

13 786

Accumulated funds at the end of the year

1

13 147

15 820

PPS

INTEGRATED REPORT

2017

164