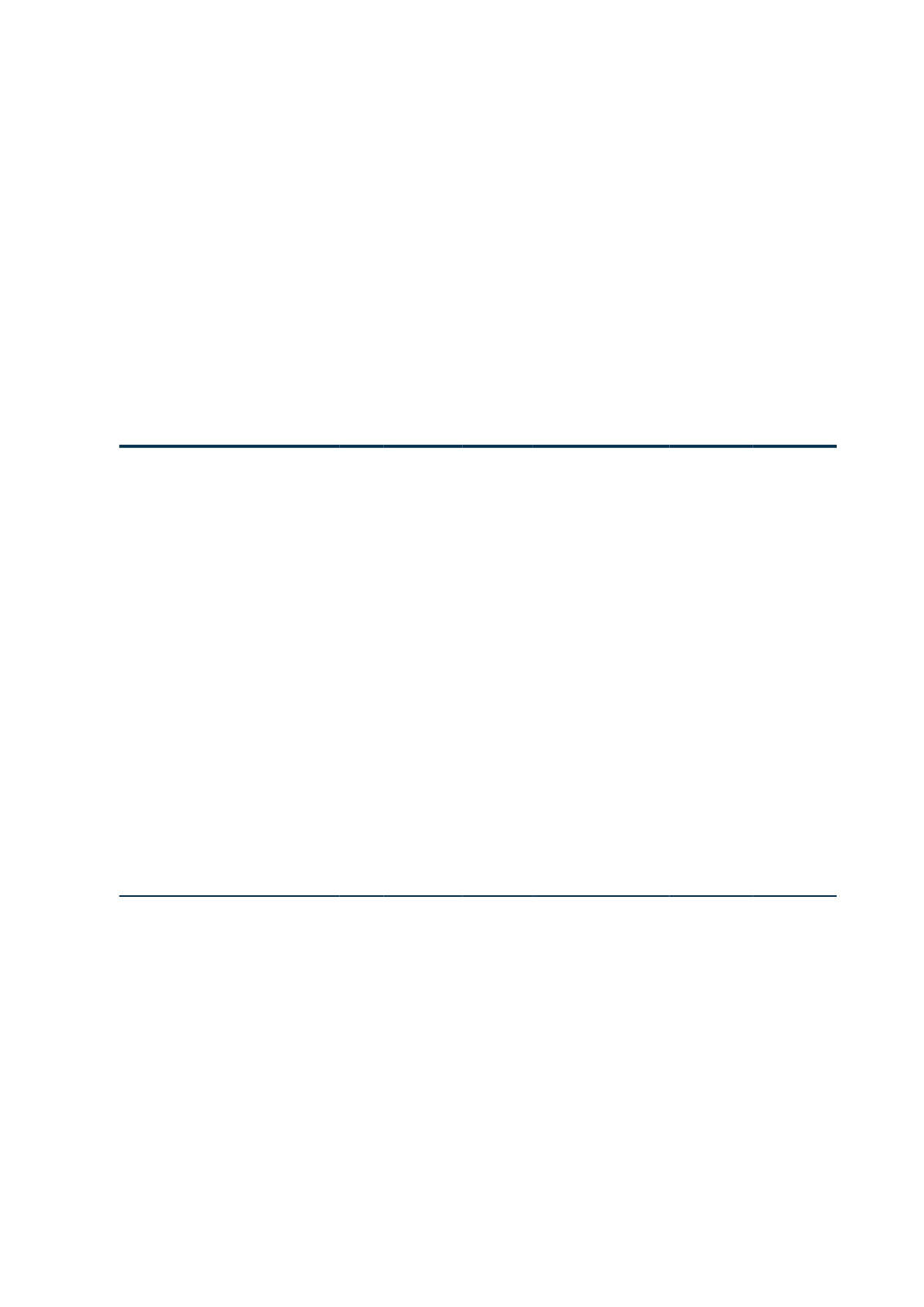

1. FINANCIAL INSTRUMENT AND INSURANCE CONTRACT ANALYSIS

The tables analyse each class of financial instrument and insurance contracts per category as well as provide their fair values,

where applicable.

R'000

Note

Financial

assets and

liabilities

designated

at fair value

through

profit or loss

on initial

recognition

Financial

assets and

liabilities

at

amortised

cost

Insurance

contract

assets and

liabilities

Pre-

payments

Total

carrying

amount

Fair value

Group 2016

Equity securities

Local listed

5 12 815 373

–

–

– 12 815 373 12 815 373

International listed

5 59 285

–

–

–

59 285

59 285

Debt securities

Government and local bonds

5 6 684 947

–

–

– 6 684 947 6 684 947

International listed

5 201 335

–

–

–

201 335 201 335

Unit trusts and pooled funds

5 17 229 378

–

–

– 17 229 378 17 229 378

Reinsurance assets

6

–

– 75 706

–

75 706

N/A

Insurance receivables

7

–

– 32 829

–

32 829

N/A

Prepayments

7

–

–

– 39 959

39 959

39 959

Other receivables

7

– 291 538

–

–

291 538 291 538

Reinsurance receivables

7

–

– 56 657

–

56 657

N/A

Cash and cash equivalents

8 1 527 746 388 893

–

– 1 916 639 1 916 639

Insurance contract liabilities

12

–

– 28 199 985

– 28 199 985

N/A

Short-term insurance policy liabilities

13

–

– 16 463

–

16 463

N/A

Investment contract liabilities

14 1 464 986

–

–

– 1 464 986 1 464 986

Liabilities to unit trust holders

15 9 088 757

–

–

– 9 088 757 9 088 757

Borrowings

16

– 186 379

–

–

186 379 186 379

Reinsurance payables

20

–

– 22 270

–

22 270

N/A

Insurance payables

20

–

– 46 995

–

46 995

N/A

Accruals and sundry creditors

20

– 652 213

–

–

652 213

652 213

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

for the year ended

31 December 2017

107