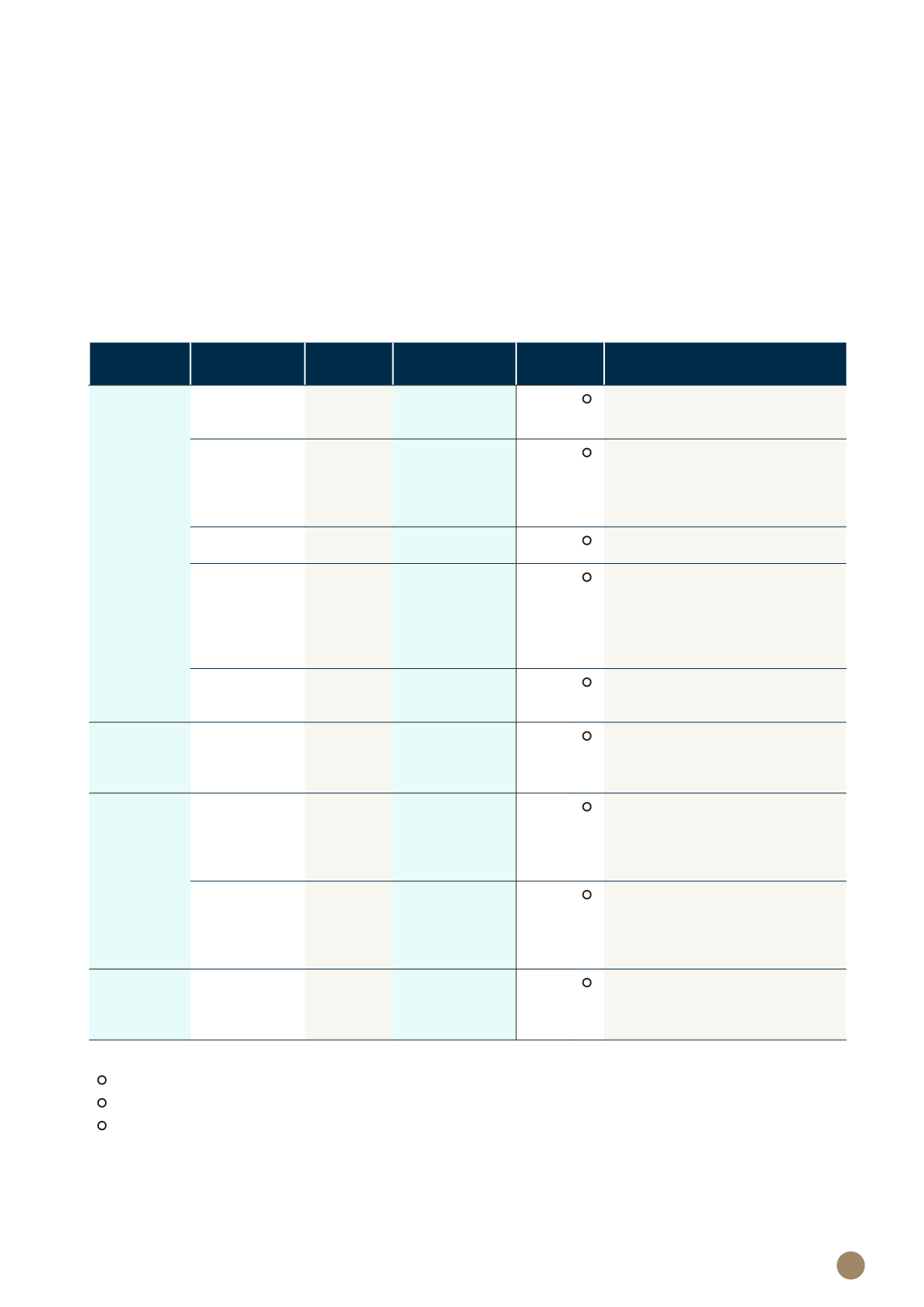

KEY PERFORMANCE

INDICATORS (KPI’S)

The performance of our management and staff is measured on a balanced scorecard basis with an equal weighting

for both financial and non-financial measures.

The KPI’s are categorised under mutuality, financial stability, service and staff, which in turn tie back to our key

strategic priorities for the Group.

HOW DID WE DO IN 2018?

OUR KEY

KPI'S

Unit of

measure

2018

PERFORMANCE

2018

GOAL COMMENTARY

FINANCIAL

STABILITY

Gross premium

income

Rand

billions

4.5

4.6

G

Gross premium income (long-term

and short-term) is slightly below

expectations.

Total assets*

Rand

billions

34.9

39.0

R

Total asset growth expectation is

measured over a three year rolling

period. Total assets is below the

goal due to negative investment

returns from markets in 2018.

Efficiency ratio

%

14.7

15.2

G

Cost control remains an imperative

of the Group.

New annual

premiums

Rand

millions

588.2

593.7

Y

New long-term risk premiums are

in line with prior year, but below

the internal target. The economic

environment in South Africa has

proven to be challenging for the

consumer in 2018.

New

investment

inflows

Rand

billions

5.9

5.3

G

Performance is significantly up on

prior year, and ahead of internal

target.

MEMBERSHIP

Number of

new members

recruited

during the year

Individuals

6 931

7 961

R

New member recruitment

performed below target in 2018.

SERVICE

Claims

processed

within

Service Level

Agreement

%

100.0

97.5

G

PPS aims to provide members

with world-class service. Claims

processing targets were exceeded

during the year.

Customer

satisfaction

survey results

Rating

97.8

> 80

G

Members are satisfied with our

service. The rating is based on

two important levers of service:

professionalism and first time

resolution.

STAFF

Training

spend as a

percentage of

payroll

%

6.0

> 5.2

G

Training spend is ahead of target.

* Excluding assets in unit trusts for third parties.

G

Achieved

Y

Partly achieved

R

Not achieved

39