HOW PPS ADDRESSES

PRINCIPAL RISKS AND

UNCERTAINTIES

RISKS

PPS takes care of the financial interests of its members by providing advice, products and services to optimally

create, protect and manage their wealth. Our risk appetite is determined by our ethos of mutuality and the

responsibility to operate ethically and efficiently within legislative parameters to achieve our mandate. PPS risk

management – an iterative process applied at strategic, operational and project levels – is integrated throughout

all PPS activities.

Risks are identified by ascertaining the causes and sources of events, situations or circumstances which could

materially impact the group – negatively or positively. Methods for identifying risk include monitoring of the

external environment and industry trends, risk workshops, interviews, and analyses of scenarios, data, assumptions

and audits.

Risks identified in terms of PPS criteria are evaluated for likelihood, consequence and velocity, taking into account

the effectiveness of existing controls. These factors are combined to determine a level of residual risk that is

evaluated against PPS’s approved risk appetite. At this point, PPS risk management will register these risks and

begin preparing mitigation plans.

Our process of identifying emerging risks will typically include and facilitate:

• Discussions on how emerging risk scenarios might impact business strategy.

• Consideration of key trends and developments in the insurance and wider financial services industry. How could

this impact PPS in future?

• Reviewing the emerging risks being experienced by other insurers and/or similar financial services institutions .

We track many risks on our various risk scorecards, however the following key risks may be material impacts on

our scorecard.

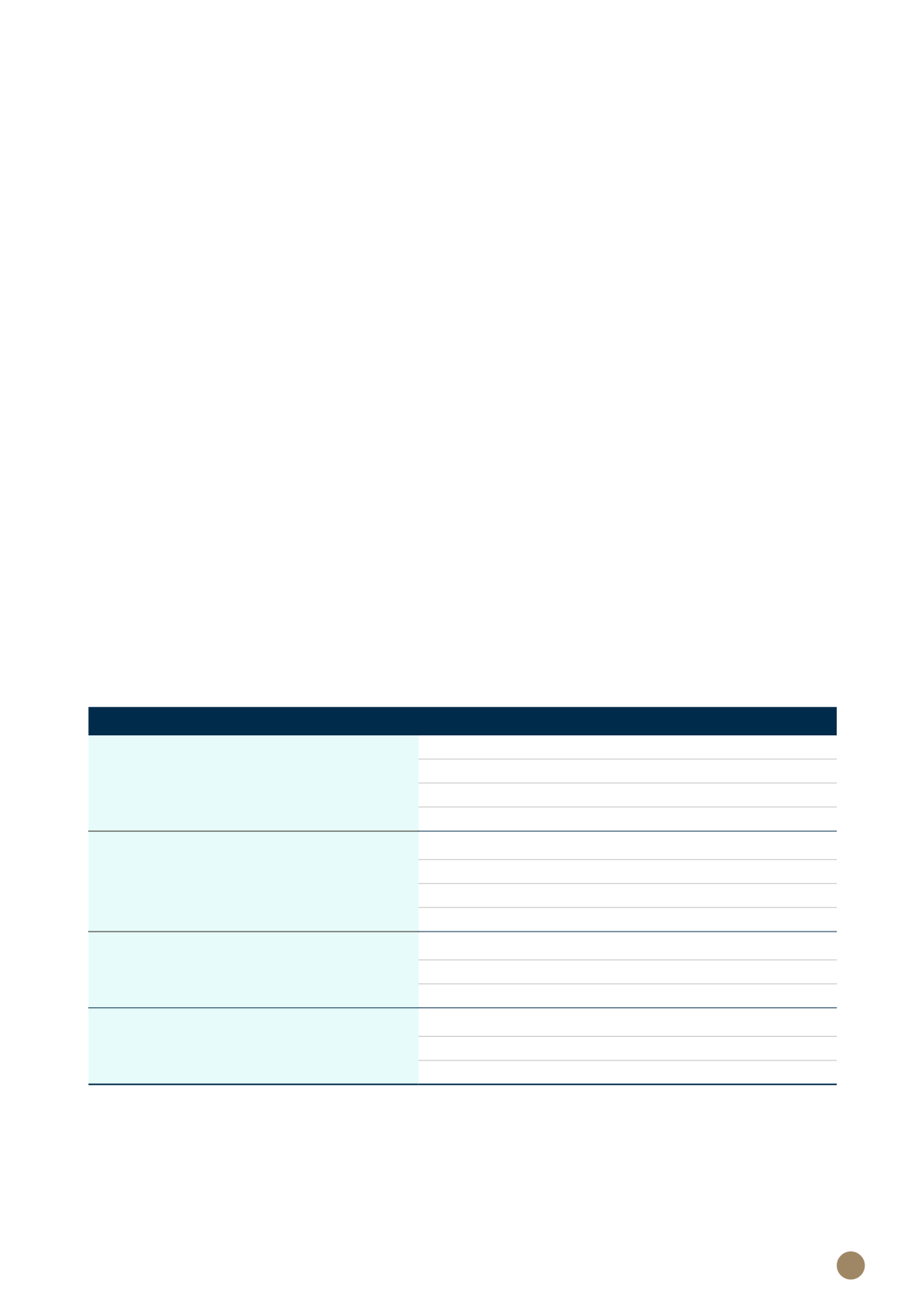

RISK

MITIGATING ACTIONS

1. Slow economic growth

• Grow our brand awareness

• Continuously review group product and service offerings

• Expand and enhance distribution channels

• Data analytics to construct big data relationships

2. Membership growth

• Continue to build member community

• Digital engagement

• PPS Credit Card

• Profit-Share Account benefits

3. Market risk and volatile investment return

• Long-term investment horizon

• Balanced portfolios with international exposure

• Multiple asset managers

4. Sustainability

• Strategic opportunities

• Exploit efficiencies

• Legislative implementation

23